Financial Risk Mitigation Strategies

In the dynamic landscape of finance, Financial risk mitigation strategies stand as a beacon of resilience, empowering businesses and individuals to navigate uncertainties and secure their financial well-being. These strategies provide a roadmap for identifying, assessing, and mitigating financial risks, enabling organizations to proactively manage their exposure and achieve sustainable growth.

From risk identification and assessment to monitoring, control, and reporting, this comprehensive guide delves into the essential elements of effective financial risk management. By embracing a proactive approach and implementing tailored strategies, organizations can safeguard their financial health, foster investor confidence, and unlock new opportunities for success.

Risk Identification and Assessment: Financial Risk Mitigation Strategies

Risk identification and assessment are crucial for financial institutions to safeguard their assets, maintain stability, and achieve long-term success. It involves identifying potential financial risks, evaluating their likelihood and potential impact, and establishing strategies to mitigate them effectively.

Identifying financial risks requires a comprehensive approach, considering both internal and external factors that could impact the institution’s financial performance. These factors may include changes in market conditions, operational inefficiencies, credit risk, liquidity risk, and regulatory compliance.

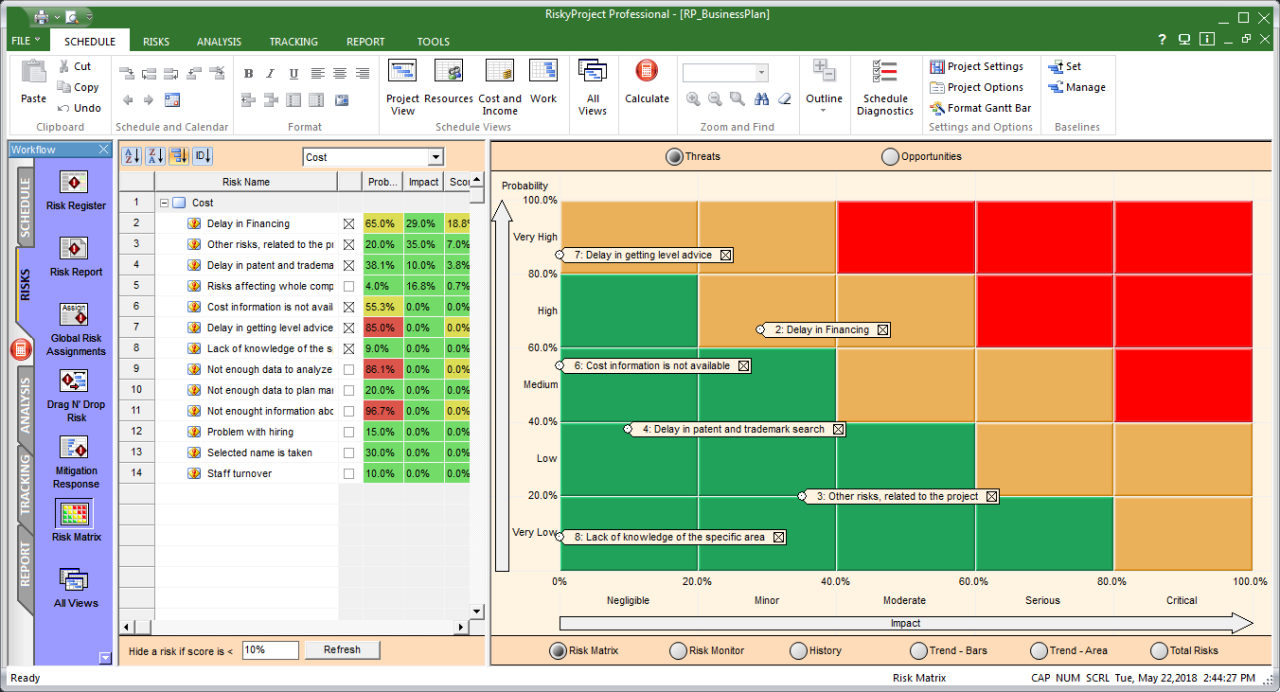

Methods for Identifying and Assessing Financial Risks

- Scenario Analysis: Developing hypothetical scenarios that represent potential risks and assessing their potential impact.

- Stress Testing: Simulating extreme market conditions or operational disruptions to evaluate the institution’s resilience and ability to withstand adverse events.

- Historical Data Analysis: Reviewing historical financial data to identify patterns and trends that may indicate potential risks.

- Risk Appetite Framework: Establishing a framework that defines the institution’s tolerance for risk and guides risk-taking decisions.

Role of Risk Appetite in Risk Assessment

Risk appetite is a crucial element in risk assessment, as it provides a benchmark against which identified risks are evaluated. By defining its risk appetite, an institution can prioritize risks based on their severity and potential impact, and allocate resources accordingly.

A well-defined risk appetite framework ensures that risk-taking is aligned with the institution’s strategic objectives and long-term goals. It also fosters a culture of risk awareness and accountability, empowering decision-makers to manage risks effectively.

Risk Mitigation Strategies

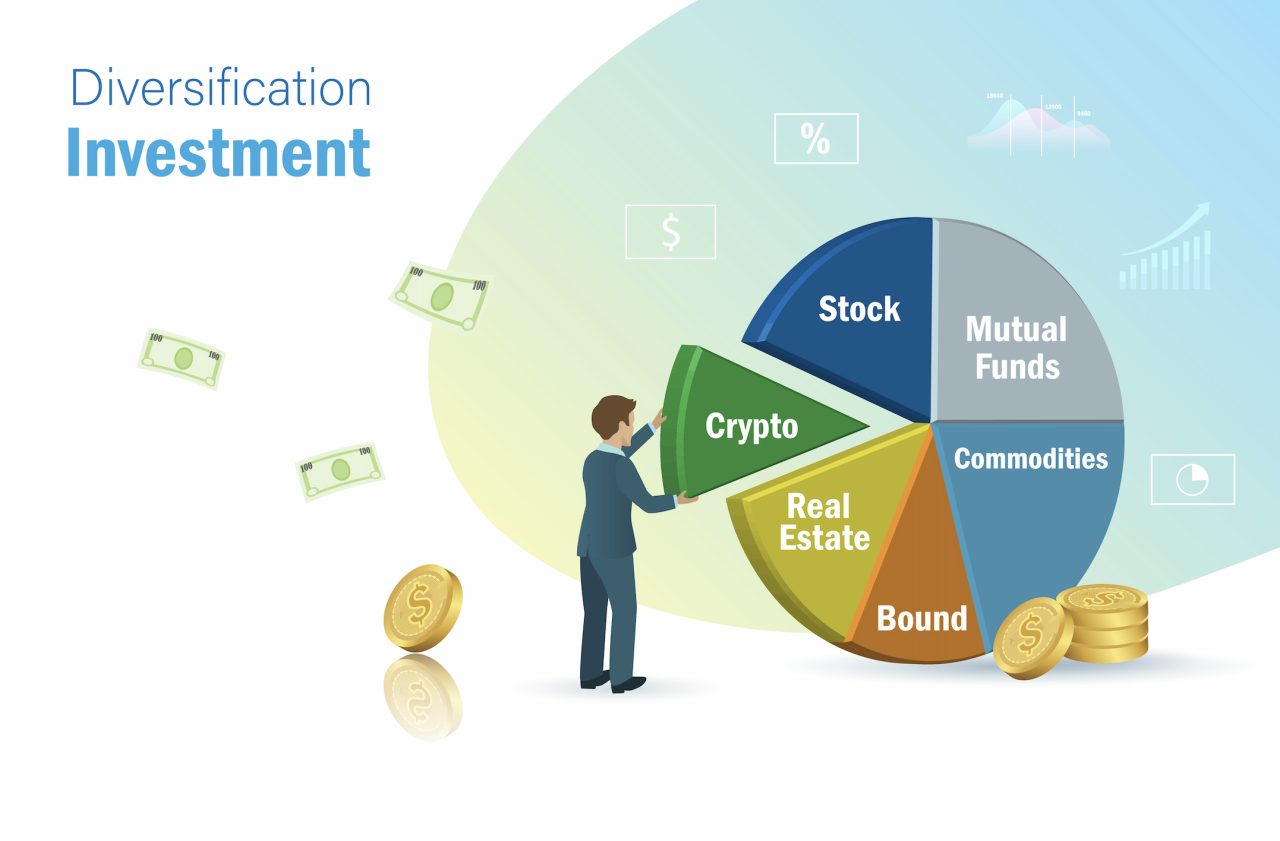

Financial risk mitigation strategies are essential for businesses to protect themselves from potential financial losses. These strategies can be implemented to reduce the impact of financial risks, such as market fluctuations, operational disruptions, and financial fraud.

There are a variety of financial risk mitigation strategies that businesses can use. The most appropriate strategy will depend on the specific risks that the business faces.

Table of Financial Risk Mitigation Strategies

The following table Artikels four common financial risk mitigation strategies, along with their advantages and disadvantages:

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Diversification | – Reduces the impact of a single risk by spreading investments across different asset classes or industries. – Can improve portfolio performance by reducing volatility. |

– Can be difficult to implement effectively. – May not be suitable for all businesses. |

| Hedging | – Reduces the risk of a specific event by using a financial instrument that moves in the opposite direction. – Can be used to protect against currency fluctuations, interest rate changes, and commodity price changes. |

– Can be expensive to implement. – May not be effective in all market conditions. |

| Insurance | – Transfers the risk of a specific event to an insurance company. – Can provide financial protection against a wide range of risks. – Can be expensive to implement. – May not cover all types of risks. |

|

| Contingency planning | – Develops plans to respond to potential risks. – Can help businesses to minimize the impact of a risk event. – Can be difficult to implement effectively. – May not be suitable for all businesses. |

Real-World Examples of Successful Risk Mitigation Strategies, Financial risk mitigation strategies

There are many real-world examples of successful risk mitigation strategies. Here are a few:

- In 2008, the global financial crisis caused many businesses to lose money. However, some businesses were able to mitigate their losses by diversifying their investments.

- In 2011, the Japanese earthquake and tsunami caused many businesses to lose money. However, some businesses were able to mitigate their losses by having contingency plans in place.

- In 2016, the Brexit vote caused many businesses to lose money. However, some businesses were able to mitigate their losses by hedging against currency fluctuations.

Risk Monitoring and Control

Effective risk monitoring and control are crucial for proactively managing financial risks and ensuring the stability and success of organizations. It involves continuously assessing and mitigating potential risks, implementing robust controls, and adapting strategies as needed.

Best practices for risk monitoring and control include establishing clear risk limits, regularly reviewing risk assessments, and conducting stress tests to assess resilience under various scenarios.

Technology’s Role in Risk Monitoring and Control

Technology plays a vital role in enhancing risk monitoring and control. Advanced analytics, machine learning algorithms, and data visualization tools enable organizations to:

- Automate risk monitoring processes, reducing manual errors and improving efficiency.

- Identify emerging risks and trends by analyzing large datasets and detecting anomalies.

- Develop predictive models to forecast potential risks and take proactive measures.

Risk Reporting and Disclosure

Effective risk reporting and disclosure are crucial for ensuring transparency, accountability, and market confidence. They enable stakeholders to understand the nature, extent, and potential impact of financial risks on an organization.

Regulatory bodies around the world have established specific requirements for risk reporting and disclosure. These requirements vary depending on the industry, size, and complexity of the organization. Common regulatory frameworks include:

Regulatory Requirements for Risk Reporting and Disclosure

- International Financial Reporting Standards (IFRS)

- Basel Accords

- Solvency II Directive (for insurance companies)

- Dodd-Frank Wall Street Reform and Consumer Protection Act (US)

These regulations typically require organizations to disclose information about their risk management policies, processes, and practices. They also specify the frequency and format of risk reporting.

Examples of Effective Risk Reporting and Disclosure Practices

- Clear and concise communication: Risk reports should be written in a clear and concise manner, using plain language that is accessible to a wide range of stakeholders.

- Quantitative and qualitative information: Reports should include both quantitative and qualitative information about risks. Quantitative information provides specific metrics and data, while qualitative information provides context and insights into the nature and severity of risks.

- Timely and regular reporting: Risk reports should be issued on a regular basis, such as quarterly or annually. Timely reporting ensures that stakeholders have up-to-date information about the organization’s risk profile.

- Independent verification: In some cases, organizations may engage independent auditors or consultants to verify the accuracy and completeness of their risk reporting.

Risk Management Culture

A strong risk management culture is essential for any organization that wants to succeed in today’s complex and uncertain business environment. It is a culture that values risk awareness, risk assessment, and risk mitigation, and it is one that is embedded in all aspects of the organization’s operations.

There are many key elements of a strong risk management culture, including:

- Leadership commitment: Senior leaders must be committed to risk management and must create an environment where risk is openly discussed and managed.

- Risk awareness: All employees must be aware of the risks that the organization faces and must understand their role in managing those risks.

- Risk assessment: The organization must have a process in place to identify, assess, and prioritize risks.

- Risk mitigation: The organization must have a process in place to develop and implement strategies to mitigate risks.

- Risk monitoring and control: The organization must have a process in place to monitor risks and to control them if they occur.

- Risk reporting and disclosure: The organization must have a process in place to report risks to stakeholders and to disclose risks in its financial statements.

Leadership plays a critical role in promoting a strong risk management culture. Leaders must create an environment where risk is openly discussed and managed. They must also set the tone for risk management by demonstrating a commitment to it themselves.

A strong risk management culture is essential for any organization that wants to succeed in today’s complex and uncertain business environment. It is a culture that values risk awareness, risk assessment, and risk mitigation, and it is one that is embedded in all aspects of the organization’s operations.

Key Questions Answered

What are the key elements of a strong financial risk management culture?

A strong financial risk management culture is characterized by a clear understanding of risk appetite, effective communication and collaboration, robust risk monitoring and control systems, and a commitment to continuous improvement.

How can technology enhance risk monitoring and control?

Technology can significantly enhance risk monitoring and control through automated risk assessment tools, real-time data analytics, and improved data visualization, enabling organizations to identify and respond to risks more efficiently and effectively.

What are some common methods for identifying financial risks?

Common methods for identifying financial risks include scenario analysis, stress testing, and risk mapping, which help organizations assess potential risks and their impact on financial performance.