Financial Portfolio Management Software Tools

Financial portfolio management software tools empower individuals and businesses to make informed decisions, optimize investments, and navigate the complexities of financial markets with ease.

These tools revolutionize the way portfolios are managed, offering a plethora of features and functions that streamline processes and ensure maximum returns on investments.

Financial portfolio management software tools are specialized programs designed to help individuals and organizations manage their investment portfolios efficiently. These tools offer a wide range of features such as portfolio tracking, performance analysis, risk assessment, and investment planning. By utilizing these software tools, users can make informed decisions, monitor their investments in real-time, and optimize their portfolio performance.

Importance of Financial Portfolio Management Software Tools

- Streamlining Investment Process: Financial portfolio management software tools automate various tasks such as data collection, analysis, and reporting, thus saving time and effort for investors.

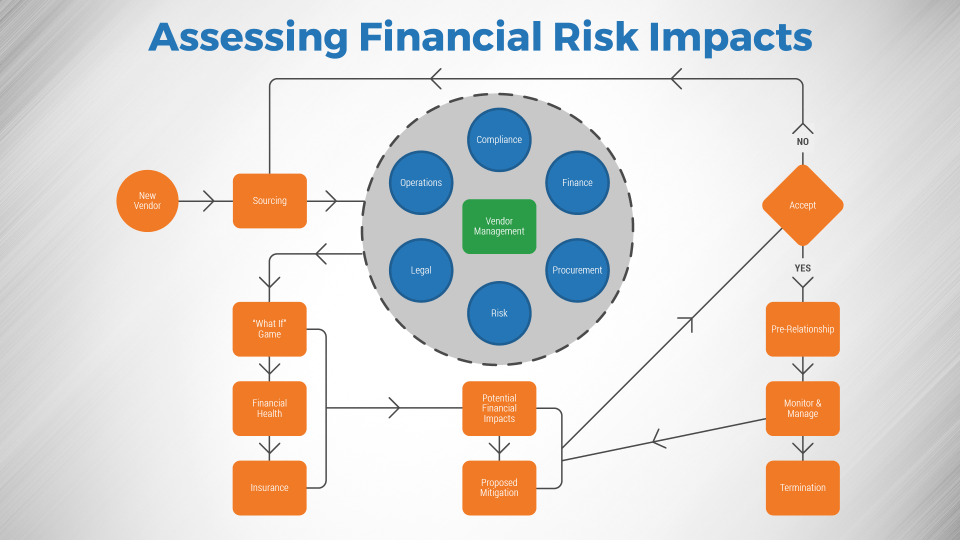

- Risk Management: These tools provide insights into the risk associated with different investment options, enabling users to make well-informed decisions to mitigate risks.

- Diversification: By offering tools to analyze portfolio diversification, users can ensure their investments are spread across different asset classes, reducing overall risk.

Optimizing Investment Decisions with Software Tools

- Performance Tracking: Software tools allow users to track the performance of their investments over time, helping them identify underperforming assets and make necessary adjustments.

- Asset Allocation: These tools provide recommendations on asset allocation based on user-defined goals and risk tolerance, helping investors create a well-balanced portfolio.

- Financial Planning: Users can create financial goals, simulate different scenarios, and assess the impact of their investment decisions on their overall financial health.

Popular Financial Portfolio Management Software Tools

- Personal Capital: Known for its robust financial tracking and planning features, Personal Capital offers a comprehensive solution for managing personal finances and investments.

- Morningstar: A trusted name in the finance industry, Morningstar provides in-depth analysis and research tools to help investors make well-informed decisions.

- Robinhood: Popular among beginner investors, Robinhood offers commission-free trading and a user-friendly interface for managing investments.

Features and Functions of Financial Portfolio Management Software Tools

In the world of financial portfolio management, software tools play a crucial role in helping investors track, analyze, and optimize their investments. These tools come equipped with a wide range of features and functions to make the process more efficient and effective.

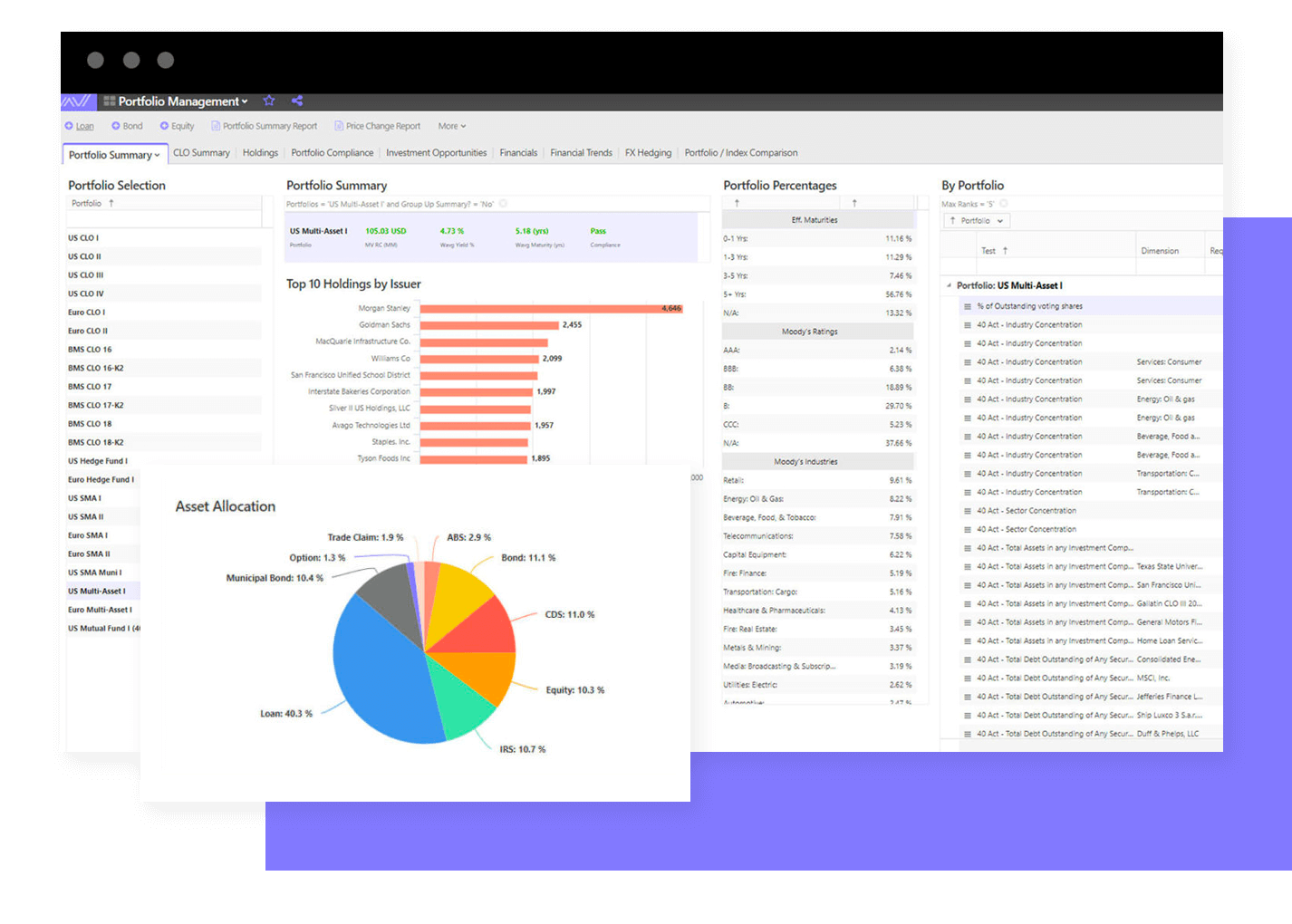

One key feature commonly found in financial portfolio management software tools is the ability to aggregate all investment accounts in one place. This allows users to have a comprehensive view of their entire portfolio, including stocks, bonds, mutual funds, and other assets.

Another important feature is the ability to track investment performance. These tools provide detailed reports and analytics to help users understand how their investments are performing over time. This includes tracking returns, analyzing risk, and comparing performance against benchmarks.

Automation is also a key aspect of financial portfolio management software tools. By automating tasks such as data entry, portfolio rebalancing, and investment tracking, users can save time and reduce the risk of human error in managing their investments.

Different software tools offer unique functions that cater to specific needs of investors. Some tools may focus on tax optimization, while others may emphasize social responsible investing or options trading. It’s important for users to compare different software tools based on their individual requirements and investment goals to find the one that best suits their needs.

Implementation and Integration of Financial Portfolio Management Software Tools

Implementing and integrating financial portfolio management software tools can greatly enhance the efficiency and effectiveness of managing financial portfolios. By following the right steps and tips, users can maximize the benefits of these tools and streamline their portfolio management process.

Steps for Implementing Financial Portfolio Management Software Tools

- Define objectives and goals: Clearly Artikel what you aim to achieve with the software tools and how they will align with your overall financial strategy.

- Choose the right software: Select a software tool that meets your specific needs and requirements, considering factors such as user interface, features, and compatibility with existing systems.

- Training and onboarding: Provide adequate training to users to ensure they fully understand how to use the software effectively and efficiently.

- Data migration: Transfer relevant data from existing systems to the new software tool to ensure a seamless transition and continuity in portfolio management.

- Testing and evaluation: Conduct thorough testing of the software to identify any issues or bugs before fully integrating it into your workflow.

Integration with Existing Systems or Platforms

- API integration: Utilize Application Programming Interfaces (APIs) to connect the software tool with other systems, enabling data exchange and synchronization.

- Customization: Customize the software tool to fit seamlessly into your existing systems and workflows, ensuring a smooth integration process.

- Data synchronization: Ensure that data is synchronized across all platforms to avoid discrepancies and ensure accurate portfolio management.

Tips for Effectively Using Financial Portfolio Management Software Tools

- Regular updates: Stay informed about new features and updates to make the most of the software tool’s capabilities.

- Utilize automation: Take advantage of automation features to streamline repetitive tasks and save time in portfolio management.

- Monitor performance: Keep track of the software tool’s performance and make adjustments as needed to optimize its usage.

Best Practices for Maximizing Benefits of Software Tools

- Set clear objectives: Define clear goals and objectives for using the software tools to ensure alignment with your financial strategy.

- Collaborate with team members: Encourage collaboration and communication among team members to leverage the software tools effectively.

- Regular evaluations: Periodically evaluate the software tools’ performance and seek feedback from users to identify areas for improvement.

Security and Compliance Considerations in Financial Portfolio Management Software Tools

When it comes to financial portfolio management software tools, security and compliance are of utmost importance to protect sensitive financial data and ensure regulatory requirements are met. These tools handle a vast amount of financial information, making them prime targets for cyber threats and breaches.

Importance of Security Measures, Financial portfolio management software tools

Financial portfolio management software tools must implement robust security measures to safeguard against unauthorized access, data breaches, and cyber attacks. Encryption techniques, secure login processes, and multi-factor authentication are essential components in ensuring the confidentiality and integrity of financial data.

Data Privacy and Protection

To maintain data privacy and protection, these software tools often employ encryption protocols to secure data both at rest and in transit. Additionally, access controls and permission settings help restrict access to sensitive information only to authorized personnel, minimizing the risk of data exposure.

Compliance Requirements

Financial portfolio management software tools need to meet various compliance requirements, such as GDPR, HIPAA, and SEC regulations, depending on the type of financial data being managed. Compliance ensures that the software adheres to industry standards and legal obligations, protecting both the organization and its clients.

Essential Security Features

– Secure Socket Layer (SSL) encryption for data transmission.

– Role-based access control to limit user privileges.

– Audit trails to track user activity and changes made to the system.

– Regular security assessments and vulnerability scans to identify and address potential weaknesses.

– Data backup and recovery procedures to prevent data loss in case of system failure or cyber attack.

Essential FAQs

How do financial portfolio management software tools help in optimizing investment decisions?

These tools analyze market trends, track portfolio performance, and provide valuable insights to make informed investment decisions effectively.

What are some popular financial portfolio management software tools in the market?

Some popular tools include Personal Capital, Quicken, and Wealthfront, known for their user-friendly interfaces and comprehensive features.