Financial Decision-Making Software

As Financial decision-making software takes center stage, this opening passage beckons readers with an inspirational and positive tone into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Financial decision-making software has emerged as a powerful tool for businesses and individuals alike, providing valuable insights and aiding in the navigation of complex financial landscapes. This comprehensive guide delves into the features, functionalities, and impact of financial decision-making software, empowering readers to make informed decisions that drive success.

Features and Functionality

Financial decision-making software empowers users with a comprehensive suite of features designed to simplify and enhance the decision-making process. These features encompass a wide range of capabilities that cater to the specific needs of financial professionals and individuals.

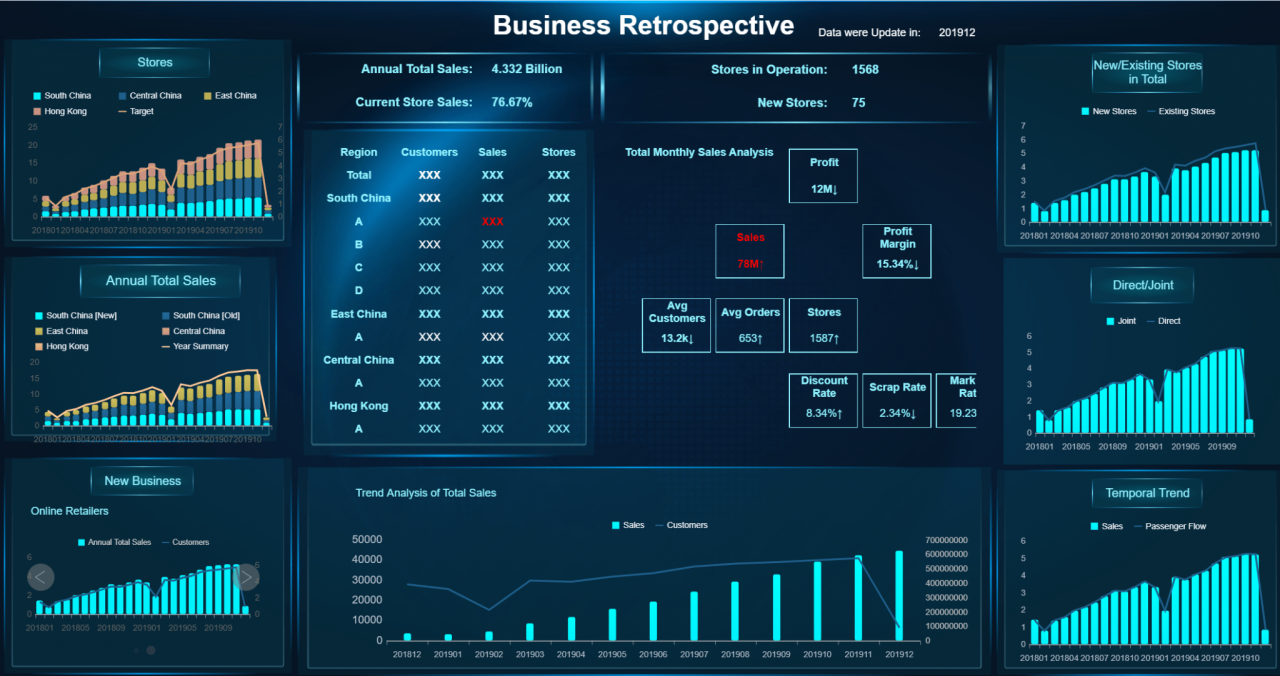

One of the key functionalities of financial decision-making software is its ability to gather and organize financial data from multiple sources. This data can include historical performance, market trends, and real-time information, providing users with a consolidated view of their financial situation. The software can also perform complex calculations and analysis, enabling users to assess different scenarios and make informed decisions.

Data Management, Financial decision-making software

Financial decision-making software provides robust data management capabilities that allow users to import, organize, and analyze financial data from various sources. This data can include:

- Historical financial statements

- Market data

- Real-time financial information

- Personal financial data

The software can automatically update and consolidate this data, providing users with a comprehensive view of their financial situation.

Scenario Analysis

Financial decision-making software enables users to perform scenario analysis, which involves simulating different financial outcomes based on various assumptions and inputs. This allows users to assess the potential impact of different decisions and make informed choices.

- Estimate future financial performance

- Evaluate the impact of investment decisions

- Assess the risk of different financial strategies

Optimization

Financial decision-making software can also perform optimization, which involves finding the best possible solution to a financial problem given a set of constraints. This can be used to:

- Maximize investment returns

- Minimize financial risk

- Create optimal financial plans

Reporting

Financial decision-making software provides powerful reporting capabilities that allow users to generate customizable reports and visualizations. These reports can be used to:

- Track financial performance

- Identify trends and patterns

- Communicate financial information to stakeholders

Types of Financial Decision-Making Software

Financial decision-making software encompasses a diverse range of tools tailored to specific needs and target audiences. Understanding the various types available empowers individuals and businesses to make informed choices that align with their financial goals.

Different types of financial decision-making software cater to specific financial management needs. These include:

Personal Finance Software

Personal finance software is designed to assist individuals in managing their personal finances effectively. It offers features such as budgeting, expense tracking, investment tracking, and debt management. This type of software is ideal for individuals looking to gain control over their finances, reduce debt, and plan for the future.

Business Finance Software

Business finance software is tailored to the needs of businesses of all sizes. It provides comprehensive financial management capabilities, including financial reporting, cash flow analysis, budgeting, and forecasting. Business finance software helps businesses make informed decisions regarding resource allocation, investment opportunities, and financial planning.

Investment Management Software

Investment management software assists individuals and investment professionals in managing investment portfolios. It offers features such as portfolio tracking, performance analysis, risk management, and trade execution. Investment management software is designed to optimize investment returns and mitigate risks.

Tax Preparation Software

Tax preparation software guides individuals and businesses through the complex process of preparing and filing tax returns. It automates calculations, ensures accuracy, and provides guidance on tax deductions and credits. Tax preparation software simplifies the tax filing process and helps users maximize tax savings.

Each type of financial decision-making software has its own strengths and weaknesses. Personal finance software is user-friendly and affordable, but it may lack advanced features. Business finance software is comprehensive, but it can be complex and expensive. Investment management software offers sophisticated tools, but it requires a high level of financial expertise. Tax preparation software is convenient, but it may not be suitable for complex tax situations.

Choosing the right type of financial decision-making software depends on individual needs and circumstances. By carefully considering the available options and their capabilities, individuals and businesses can select the software that best meets their financial management requirements.

Integration with Other Systems

Financial decision-making software seamlessly integrates with other financial systems, enabling comprehensive data consolidation and enhanced decision-making.

For instance, integrating with accounting software allows for real-time access to financial data, facilitating accurate cash flow forecasting and investment analysis. Additionally, integrating with CRM systems provides insights into customer behavior, enabling targeted financial decisions.

Successful Integrations

- A manufacturing company integrated financial decision-making software with its ERP system, resulting in improved inventory management and a 15% reduction in operating costs.

- A financial institution integrated software with its risk management system, enhancing risk assessment and reducing potential losses by 20%.

Challenges and Best Practices

Integrating software systems poses challenges such as data compatibility and security concerns. Best practices include:

- Establishing clear data standards and protocols.

- Implementing robust security measures to protect sensitive data.

- Conducting thorough testing and validation before deployment.

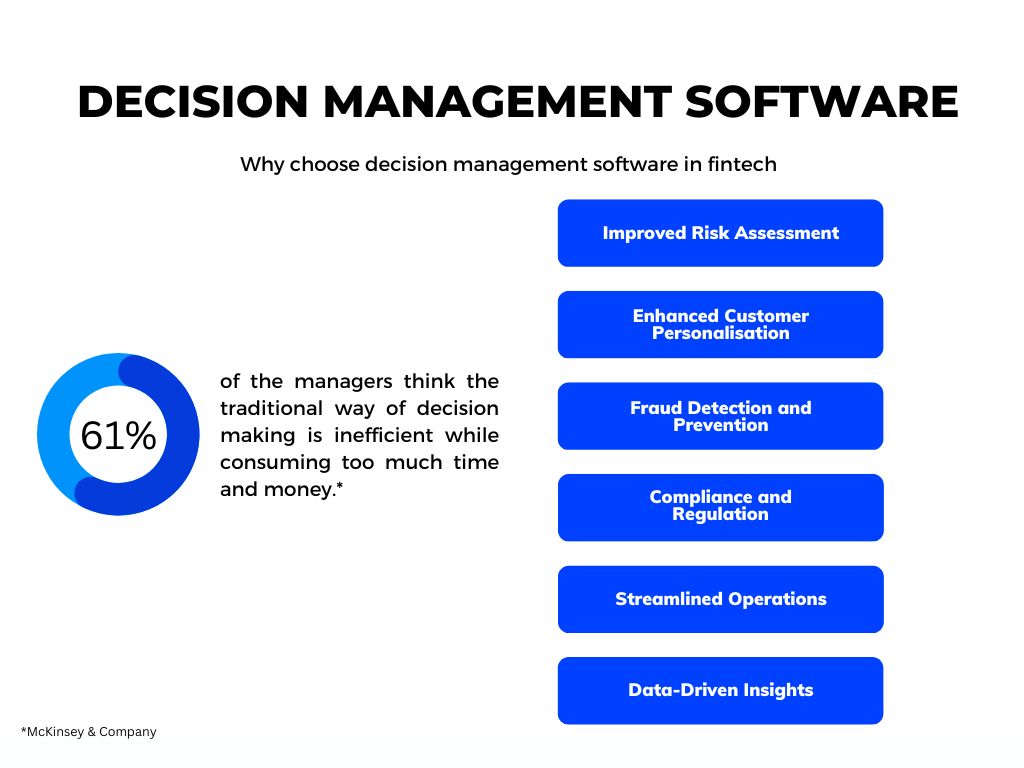

Impact on Decision-Making Process

Financial decision-making software plays a significant role in enhancing the decision-making process by providing data analysis, risk assessment, and predictive modeling capabilities. It automates complex calculations, generates insights, and presents information in a clear and concise manner, enabling decision-makers to make informed choices.

Real-World Examples

* Investment Analysis: Software helps investors analyze market trends, compare investment options, and optimize portfolios based on risk tolerance and financial goals. It provides real-time data, risk-adjusted performance metrics, and portfolio optimization tools, leading to better investment decisions and higher returns.

* Credit Risk Management: Banks and lenders use software to assess creditworthiness, manage loan portfolios, and mitigate risk. It analyzes financial statements, calculates credit scores, and simulates different economic scenarios to predict default probabilities and optimize lending decisions.

Limitations and Drawbacks

While financial decision-making software offers numerous benefits, it also has limitations:

* Data Quality: The accuracy of software outputs depends on the quality of the input data. Poor data can lead to unreliable results and biased decisions.

* Algorithmic Bias: Software algorithms may contain biases that can influence decision-making. For example, an algorithm trained on historical data may perpetuate existing biases in the financial system.

* Over-reliance: Over-reliance on software can lead to a loss of human judgment and decision-making skills. Decision-makers should use software as a tool to support their analysis, but not as a replacement for their own critical thinking and experience.

5. Trends and Future Developments

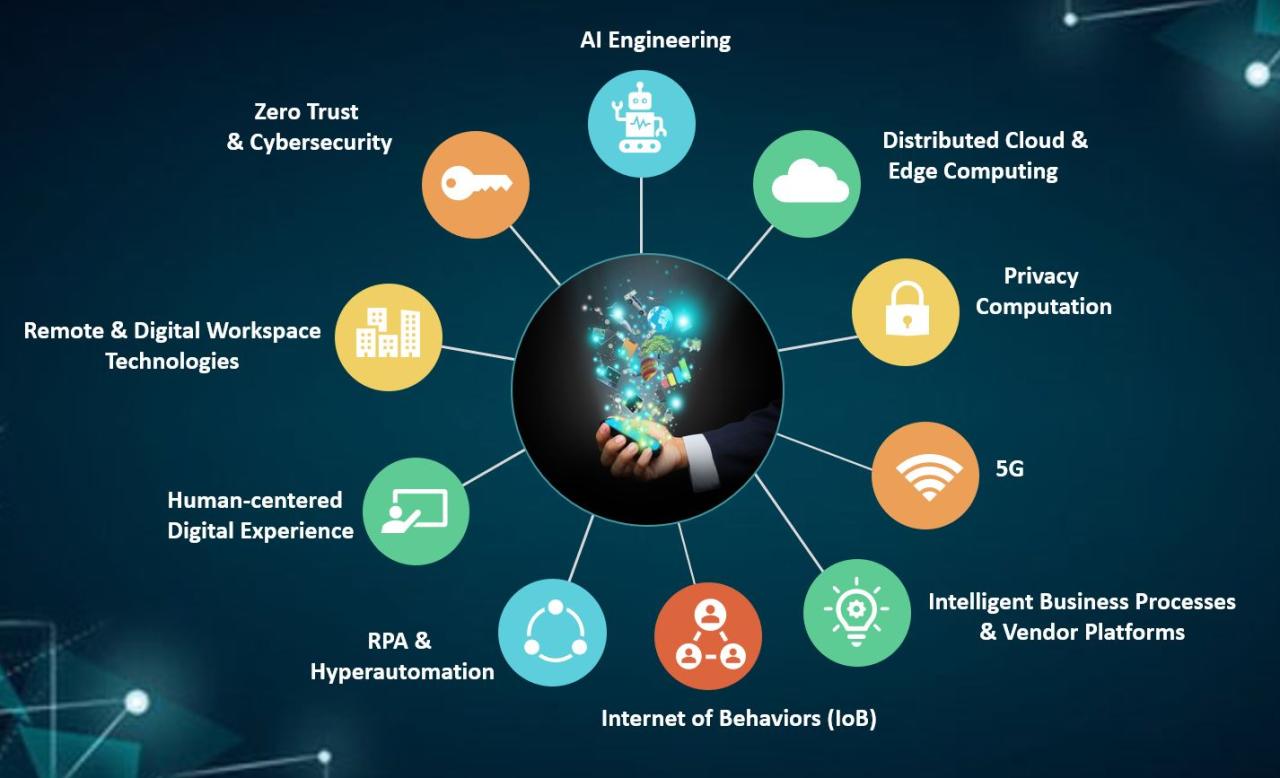

The financial decision-making software industry is constantly evolving, with new trends and developments emerging all the time. These trends are being driven by a number of factors, including the increasing availability of data, the rise of artificial intelligence (AI), and the growing need for businesses to make better decisions in a complex and uncertain world.

One of the most important trends in financial decision-making software is the increasing use of AI. AI can be used to automate a variety of tasks, from data analysis to model building, freeing up financial professionals to focus on more strategic activities. AI can also be used to improve the accuracy and speed of financial decision-making, by identifying patterns and insights that would be difficult or impossible for humans to find on their own.

The Role of Artificial Intelligence and Machine Learning

AI and machine learning are already having a significant impact on the financial decision-making software industry, and their role is only expected to grow in the future. AI can be used to automate a variety of tasks, from data analysis to model building, freeing up financial professionals to focus on more strategic activities. AI can also be used to improve the accuracy and speed of financial decision-making, by identifying patterns and insights that would be difficult or impossible for humans to find on their own.

For example, AI can be used to:

- Identify fraud and money laundering

- Analyze market data to identify trading opportunities

- Build predictive models to forecast financial performance

- Automate investment decisions

As AI continues to develop, it is likely to have an even greater impact on the financial decision-making software industry. AI-powered tools will become more sophisticated and easier to use, making them accessible to a wider range of businesses. This will lead to a new era of financial decision-making, where AI and human intelligence work together to make better decisions.

Question Bank

What are the key features of financial decision-making software?

Financial decision-making software typically offers features such as budgeting, cash flow analysis, scenario planning, investment tracking, and risk assessment.

How can financial decision-making software improve my decision-making process?

By providing real-time data, automating calculations, and offering expert insights, financial decision-making software helps you make more informed and strategic decisions.

Is financial decision-making software suitable for both businesses and individuals?

Yes, financial decision-making software is designed to meet the needs of both businesses and individuals, offering tailored solutions for different levels of complexity and scale.