Financial Investment Portfolio Software Diversification Strategies

Financial investment portfolio software diversification strategies emerge as a beacon of financial prudence, illuminating the path towards investment success. This comprehensive guide delves into the intricacies of portfolio diversification, empowering investors with the knowledge and tools to navigate market volatility and achieve their financial aspirations.

Through a blend of expert insights and practical examples, we explore the diverse strategies and software solutions that enable investors to spread their risk, enhance returns, and build resilient portfolios that withstand the test of time.

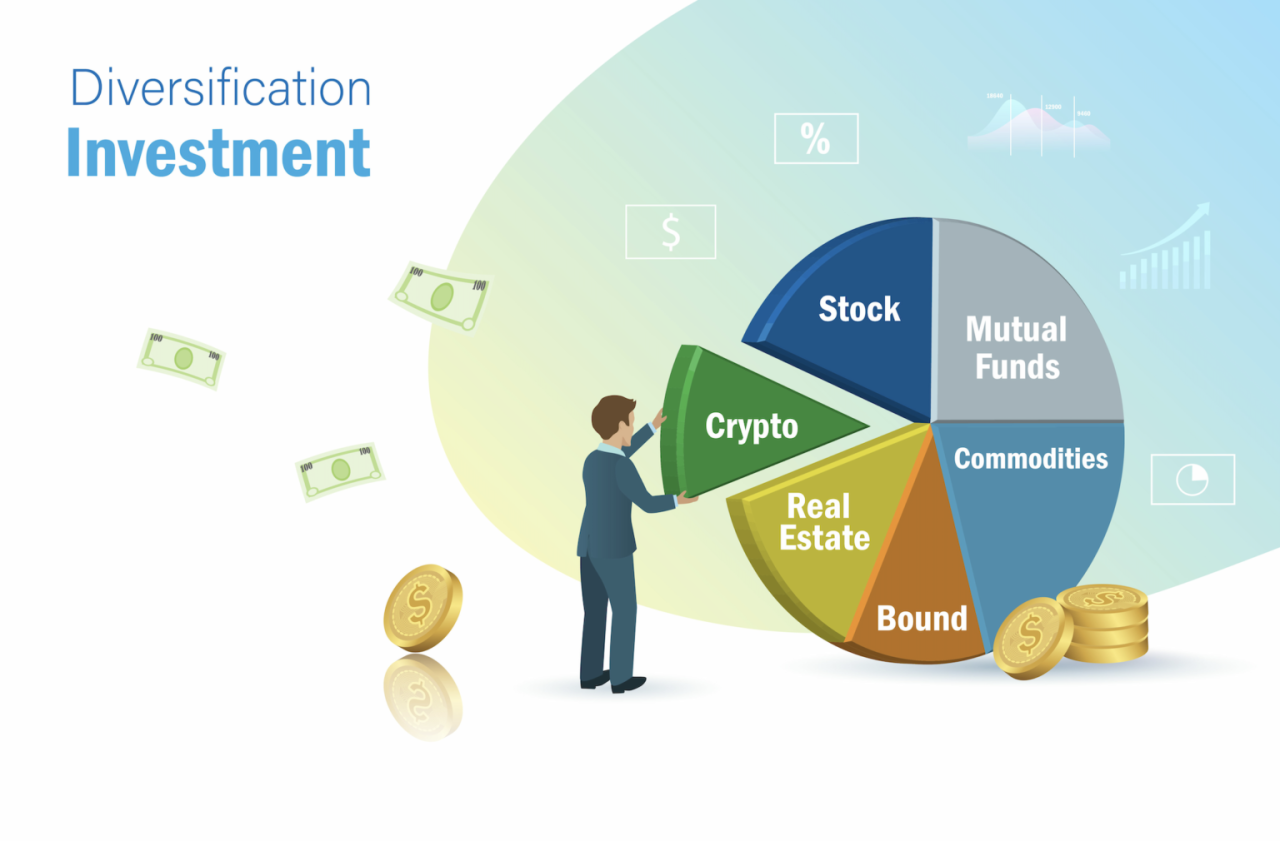

Diversification Strategies for Financial Investment Portfolios

Diversification is a risk management strategy that involves spreading investments across a variety of assets, industries, and geographic regions. By doing so, investors can reduce the risk of losing money in any one investment.

There are many benefits to diversifying investment portfolios. First, it can help to reduce the risk of losing money. Second, it can help to improve the overall return on investment. Third, it can help to reduce the volatility of investment returns.

There are many different types of diversification strategies. One common strategy is to diversify by asset class. This involves investing in a variety of assets, such as stocks, bonds, real estate, and commodities. Another common strategy is to diversify by industry. This involves investing in a variety of industries, such as technology, healthcare, and consumer goods.

There are many ways to implement diversification strategies in investment portfolios. One way is to invest in mutual funds or exchange-traded funds (ETFs). These funds are professionally managed and offer a diversified portfolio of investments.

Another way to implement diversification strategies is to invest directly in individual stocks and bonds. This can be a more challenging and time-consuming approach, but it can also be more rewarding.

Diversification is an important part of any investment strategy. By diversifying their portfolios, investors can reduce the risk of losing money, improve the overall return on investment, and reduce the volatility of investment returns.

Software Tools for Portfolio Diversification

Software tools for portfolio diversification can help investors create and manage diversified portfolios that align with their risk tolerance and financial goals. These tools provide a range of features and benefits that can make the diversification process more efficient and effective.

Types of Software Tools

There are several different types of software tools available for portfolio diversification, including:

- Portfolio analyzers: These tools allow investors to analyze their existing portfolios and identify areas where diversification can be improved.

- Portfolio optimizers: These tools use mathematical models to create diversified portfolios that meet specific risk and return objectives.

- Asset allocation tools: These tools help investors determine the appropriate allocation of assets across different asset classes, such as stocks, bonds, and real estate.

- Rebalancing tools: These tools help investors maintain their desired portfolio allocations over time by automatically adjusting the portfolio as market conditions change.

Features and Benefits

Software tools for portfolio diversification offer a number of features and benefits, including:

- Automated analysis: These tools can quickly and efficiently analyze large amounts of data to identify diversification opportunities.

- Objectivity: These tools can provide objective recommendations based on mathematical models, reducing the impact of emotional decision-making.

- Time savings: These tools can save investors a significant amount of time by automating the diversification process.

- Improved returns: By creating diversified portfolios, these tools can help investors improve their returns over the long term.

Popular Software Tools

Some of the most popular software tools used for portfolio diversification include:

- Morningstar Portfolio Manager

- Personal Capital

- Betterment

- Wealthfront

- Vanguard Digital Advisor

| Feature | Morningstar Portfolio Manager | Personal Capital | Betterment | Wealthfront | Vanguard Digital Advisor |

|---|---|---|---|---|---|

| Portfolio analysis | Yes | Yes | Yes | Yes | Yes |

| Portfolio optimization | Yes | Yes | Yes | Yes | Yes |

| Asset allocation | Yes | Yes | Yes | Yes | Yes |

| Rebalancing | Yes | Yes | Yes | Yes | Yes |

| Cost | $199/year | Free | 0.25% of assets under management | 0.25% of assets under management | 0% of assets under management |

Best Practices for Portfolio Diversification: Financial Investment Portfolio Software Diversification Strategies

Diversifying investment portfolios is a crucial strategy to manage risk and enhance returns. By following best practices, investors can optimize their portfolios for their specific financial goals and risk tolerance.

Asset Allocation

Asset allocation is the foundation of portfolio diversification. It involves dividing the portfolio into different asset classes, such as stocks, bonds, real estate, and commodities. The allocation should align with the investor’s risk tolerance and investment horizon.

Risk Tolerance

Risk tolerance plays a significant role in diversification. Investors should assess their ability to withstand market fluctuations and adjust their portfolio accordingly. Higher risk tolerance allows for a higher allocation to growth-oriented assets like stocks, while lower risk tolerance calls for a more conservative approach with a higher allocation to bonds.

Rebalancing

Rebalancing is essential to maintain the desired asset allocation over time. As market conditions change, the portfolio’s composition may deviate from the target allocation. Rebalancing involves adjusting the portfolio by selling or buying assets to restore the original allocation.

Case Studies of Successful Portfolio Diversification

The study of portfolio diversification involves real-world examples that demonstrate the implementation of successful strategies. These case studies provide valuable insights into the challenges and successes of diversification, allowing investors to learn from the experiences of others.

One notable case study is the “All-Weather Portfolio” developed by Ray Dalio of Bridgewater Associates. This portfolio is designed to withstand various economic conditions by allocating assets across different asset classes, including stocks, bonds, commodities, and currencies. Over time, the All-Weather Portfolio has demonstrated resilience during market downturns and has outperformed the S&P 500 index in certain periods.

Key Takeaways from Case Studies:, Financial investment portfolio software diversification strategies

- Diversification can reduce portfolio risk without significantly sacrificing returns.

- Asset allocation should be based on an investor’s risk tolerance and investment horizon.

- Rebalancing a portfolio periodically helps maintain the desired asset allocation.

- Diversification strategies should be tailored to the specific needs of each investor.

- Regularly monitoring and adjusting a portfolio is crucial for ongoing success.

Expert Answers

What are the key benefits of portfolio diversification?

Portfolio diversification offers a multitude of benefits, including reduced risk, enhanced returns, and the ability to achieve specific financial goals.

How can I implement diversification strategies in my investment portfolio?

Implementing diversification strategies involves allocating assets across different asset classes, industries, and geographical regions to reduce risk and enhance returns.

What types of software tools are available for portfolio diversification?

Various software tools are available to assist investors with portfolio diversification, offering features such as asset allocation analysis, risk assessment, and performance tracking.