Financial Performance Tracking Software Tools Methods

Financial performance tracking software tools methods revolutionize the way businesses analyze and report financial data, offering a streamlined approach to enhancing overall performance.

With the evolution of technology, tracking financial performance has become more efficient and effective, allowing businesses to make data-driven decisions and improve their bottom line.

Introduction to Financial Performance Tracking Software Tools: Financial Performance Tracking Software Tools Methods

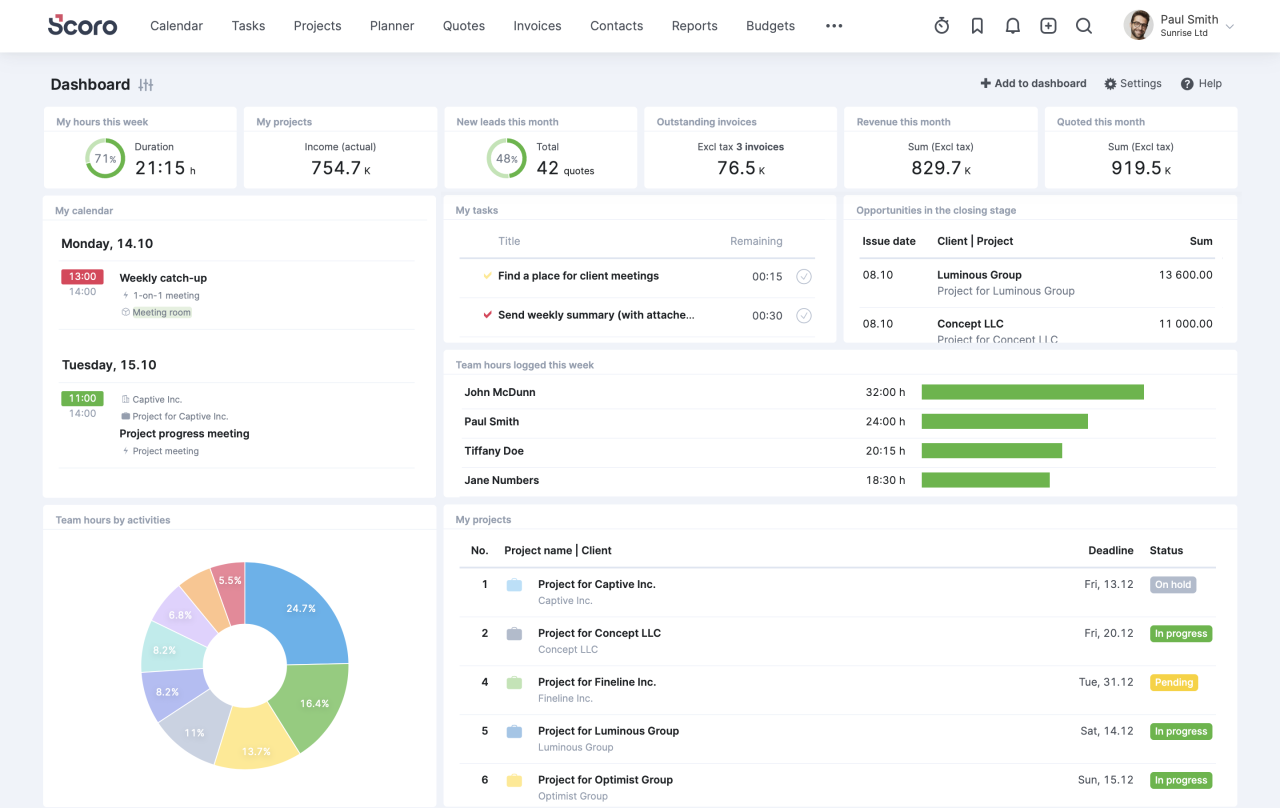

In today’s fast-paced business environment, keeping track of financial performance is crucial for making informed decisions and ensuring the success of a company. Utilizing financial performance tracking software tools can greatly enhance the efficiency and accuracy of this process.

Key Features of Financial Performance Tracking Software Tools

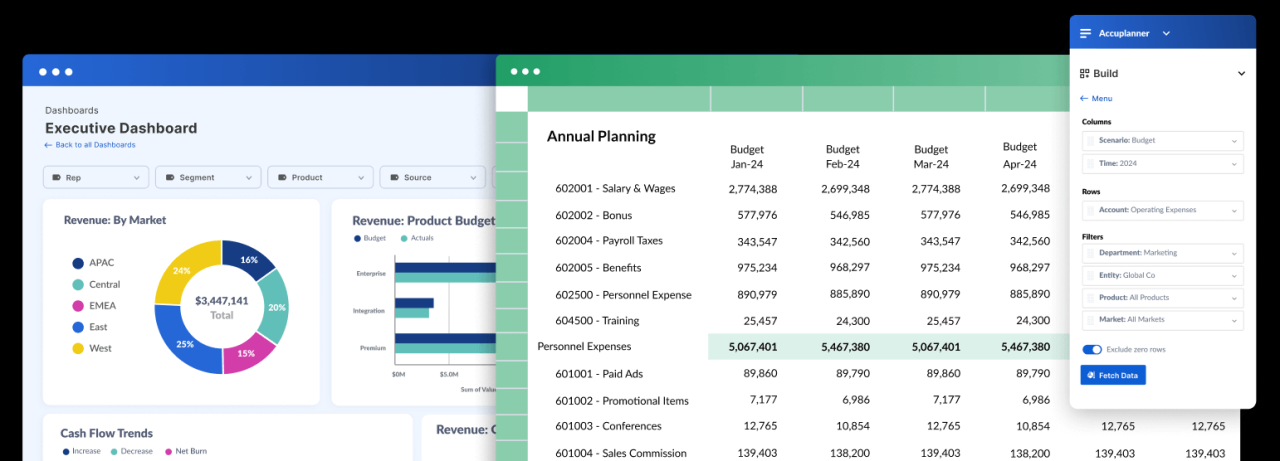

- Real-time Data Updates: These tools provide instant updates on financial data, allowing for timely decision-making.

- Customizable Dashboards: Users can create personalized dashboards to track key performance indicators (KPIs) and metrics that are most relevant to their business.

- Automated Reporting: Software tools automate the process of generating reports, saving time and reducing the risk of errors.

- Data Integration: These tools can pull data from various sources and consolidate it into one platform, providing a comprehensive view of financial performance.

Streamlining Financial Data Analysis and Reporting

Financial performance tracking software tools streamline the analysis and reporting process by eliminating manual data entry and calculation errors. With advanced features such as predictive analytics and data visualization, these tools enable users to gain valuable insights from their financial data efficiently.

Types of Financial Performance Tracking Software

When it comes to tracking financial performance, there are various types of software available to help businesses stay on top of their numbers. Let’s explore the different options and functionalities of each type.

Cloud-based vs. On-premise Financial Tracking Software

- Cloud-based Software: This type of software is hosted on remote servers and accessed through the internet. It offers the advantage of accessibility from anywhere with an internet connection, making it convenient for businesses with remote teams or multiple locations. Cloud-based software also typically offers automatic updates and scalability based on business needs.

- On-premise Software: On-premise software, on the other hand, is installed and hosted on the company’s own servers and computers. This type of software gives businesses more control over their data and security, as it is kept in-house. However, it may require more maintenance and upfront costs for hardware and IT infrastructure.

Specific Functionalities of Each Type of Software

| Functionality | Cloud-based Software | On-premise Software |

|---|---|---|

| Accessibility | Accessible from anywhere with an internet connection | Accessible only on company premises |

| Scalability | Can easily scale up or down based on business needs | May require additional hardware for scalability |

| Security | Relies on cloud provider’s security measures | Offers more control over data security |

| Cost | Often subscription-based with lower upfront costs | Higher upfront costs for hardware and setup |

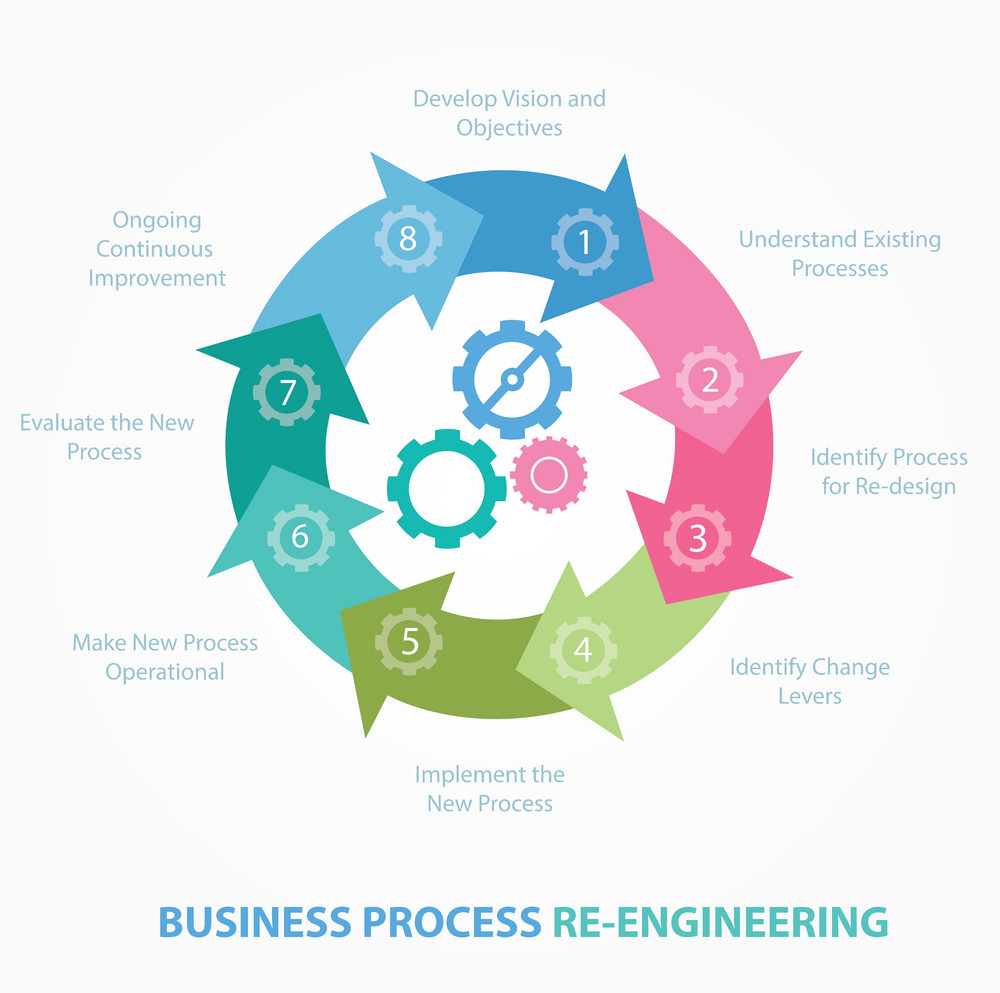

Methods for Implementing Financial Performance Tracking Software

Implementing financial performance tracking software is crucial for businesses to effectively monitor and manage their financial health. Here is a step-by-step guide on how to implement financial tracking software, best practices for integrating software tools with existing systems, and tips on data migration when transitioning to a new tracking software.

Step-by-Step Guide for Implementation

- Identify your financial tracking needs and goals: Before implementing any software, clearly define what metrics you want to track and what goals you want to achieve.

- Research and select the right software: Look for financial tracking software that aligns with your needs and budget. Consider factors like scalability, user-friendliness, and customer support.

- Customize the software: Tailor the software to fit your specific requirements by configuring settings, adding necessary integrations, and creating relevant reports.

- Train your team: Provide training sessions for all users to ensure they understand how to use the software effectively and maximize its capabilities.

- Test the software: Conduct thorough testing to identify any issues or discrepancies before fully implementing the software across your organization.

- Go live: After successful testing, roll out the software to all users and departments, ensuring a smooth transition and providing ongoing support.

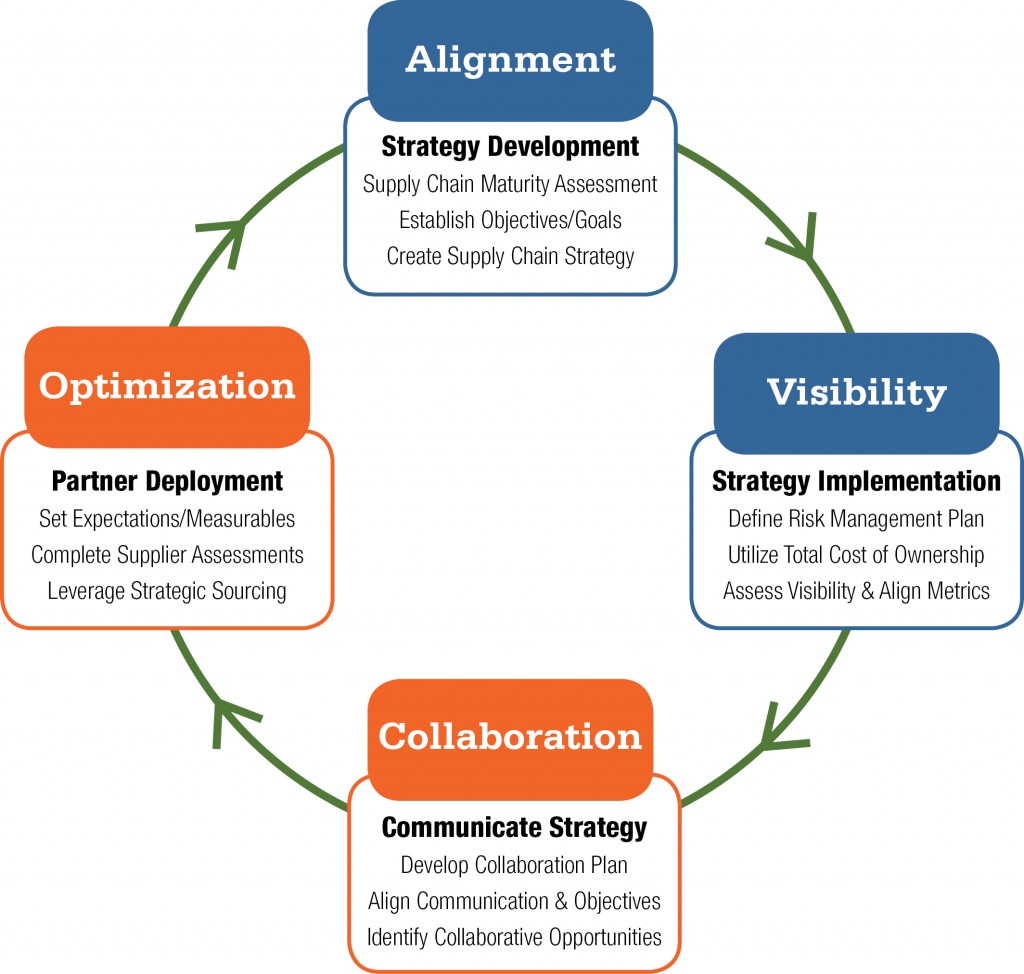

Best Practices for Integration

- Collaborate with IT and finance departments: Work closely with IT and finance teams to ensure seamless integration and alignment with existing systems and processes.

- Ensure data accuracy: Regularly synchronize data between the financial tracking software and other systems to maintain data integrity and consistency.

- Monitor performance: Continuously monitor the performance of the software and its impact on financial reporting to make necessary adjustments and improvements.

- Implement security measures: Protect sensitive financial data by implementing robust security measures, such as encryption and access controls.

Tips for Data Migration

- Plan ahead: Develop a detailed data migration plan outlining the process, timeline, and responsibilities of each team member involved.

- Cleanse and organize data: Prior to migration, clean and organize your data to eliminate duplicates, errors, and inconsistencies that could affect the accuracy of financial reports.

- Test data migration: Conduct trial migrations to identify and resolve any issues or data loss before executing the final migration.

- Backup data: Create backups of all data before migration to prevent loss or corruption of critical financial information.

Benefits of Using Financial Performance Tracking Software

Financial performance tracking software tools offer numerous advantages that can significantly impact a company’s success. One of the key benefits is the ability to improve decision-making processes by providing real-time data and insights into the financial health of the business. This allows for more informed and strategic decision-making at all levels of the organization.

Another advantage of using financial performance tracking software is the enhancement of accuracy and efficiency in financial reporting. These tools can automate the process of data collection, analysis, and reporting, reducing the risk of errors and ensuring that financial reports are both accurate and timely. This not only saves time but also improves the overall reliability of financial information.

Improved Financial Analysis, Financial performance tracking software tools methods

Using financial performance tracking software enables companies to conduct more in-depth financial analysis, identifying trends, patterns, and key performance indicators that may not be easily visible through manual methods. By having access to comprehensive and accurate financial data, organizations can make more strategic decisions to drive growth and profitability.

Enhanced Forecasting and Planning

Financial performance tracking software tools also facilitate better forecasting and planning by providing the necessary data and analytics to predict future financial outcomes. This allows businesses to anticipate potential challenges, seize opportunities, and create more realistic financial goals and strategies for the future.

Streamlined Compliance and Risk Management

Furthermore, these software tools help streamline compliance and risk management processes by ensuring that financial data is accurate, up-to-date, and in line with regulatory requirements. By automating compliance tasks and risk assessments, companies can reduce the likelihood of errors, penalties, and other financial risks.

General Inquiries

How do financial performance tracking software tools benefit businesses?

These tools streamline financial data analysis and reporting, leading to improved decision-making processes and enhanced efficiency.

What are the key features of financial performance tracking software tools?

Key features include customizable reporting, data visualization, and integration capabilities with existing systems.

What types of financial performance tracking software are available?

There are cloud-based and on-premise options, each offering specific functionalities to meet varying business needs.