Financial Risk Assessment Software Tools

Delving into the realm of Financial Risk Assessment Software Tools, this comprehensive guide offers a compelling narrative that unveils the intricacies of risk management. By harnessing the power of these tools, organizations can navigate the complexities of financial risk with greater precision, ensuring resilience and sustainable growth.

From defining the essential components of these tools to exploring their transformative benefits, this guide provides a holistic overview of the transformative role they play in modern risk management practices.

Introduction

Financial risk assessment software tools are designed to help businesses identify, assess, and manage financial risks. They can be used to assess a variety of risks, including credit risk, market risk, operational risk, and liquidity risk.

Financial risk assessment software tools can be a valuable tool for businesses of all sizes. They can help businesses to:

- Identify and assess financial risks

- Develop strategies to manage financial risks

- Monitor financial risks

- Report on financial risks

Examples of financial risk assessment software tools

There are a number of different financial risk assessment software tools available. Some of the most popular tools include:

- SAS Risk Management

- Oracle Financial Services Risk Management

- SAP Risk Management

- IBM Risk Manager

- Wolters Kluwer Compliance and Risk Management

Benefits of using financial risk assessment software tools

Financial risk assessment software tools offer a multitude of advantages that can significantly enhance the risk management capabilities of organizations. These tools empower organizations to identify, assess, and mitigate financial risks effectively, leading to improved decision-making, increased transparency, and reduced risk management costs.

Improved risk identification and assessment

Financial risk assessment software tools provide comprehensive risk identification and assessment capabilities. They enable organizations to systematically identify and categorize potential financial risks, considering both internal and external factors. These tools employ advanced algorithms and models to analyze financial data, market trends, and industry-specific risk factors, helping organizations gain a deeper understanding of their risk exposure.

Enhanced decision-making

By providing accurate and timely risk assessments, financial risk assessment software tools empower organizations to make informed decisions. These tools generate risk reports and visualizations that present complex risk information in a clear and actionable format. This enables decision-makers to prioritize risks, allocate resources effectively, and develop mitigation strategies that are tailored to their specific risk profile.

Increased transparency and accountability

Financial risk assessment software tools promote transparency and accountability within organizations. They provide a centralized platform for documenting risk assessments, tracking risk mitigation actions, and monitoring risk performance. This fosters a culture of risk awareness and accountability, ensuring that all stakeholders are aligned on risk management objectives.

Reduced cost of risk management

Financial risk assessment software tools can significantly reduce the cost of risk management. These tools automate many manual risk management processes, such as data collection, analysis, and reporting. They also enable organizations to identify and mitigate risks proactively, preventing potential losses and minimizing the need for costly reactive measures.

Key features of financial risk assessment software tools

Financial risk assessment software tools provide a comprehensive suite of features that empower organizations to effectively identify, assess, and mitigate financial risks. These tools offer a range of capabilities that streamline the risk assessment process, enhance decision-making, and promote financial stability.

Key features of financial risk assessment software tools include:

Risk identification and assessment capabilities

These tools provide robust capabilities for identifying and assessing various types of financial risks, including credit risk, market risk, operational risk, and liquidity risk. They employ advanced algorithms and data analysis techniques to evaluate the potential impact of these risks on an organization’s financial performance and stability.

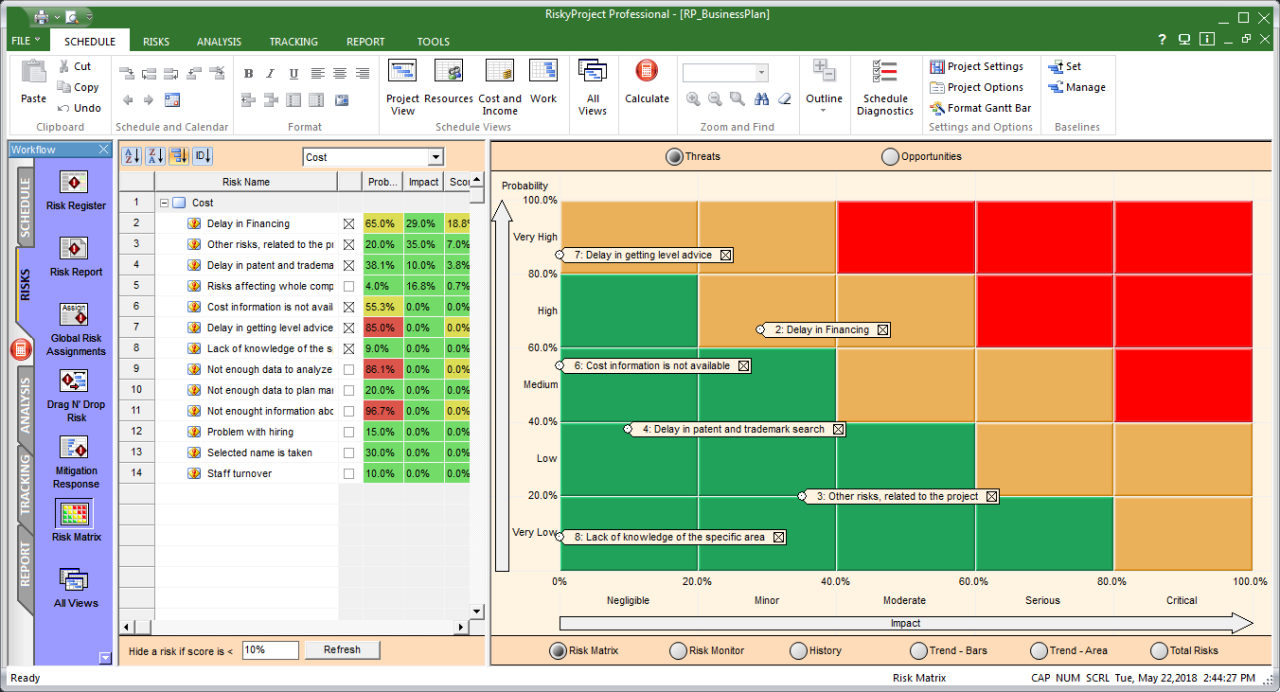

Scenario analysis and stress testing

Financial risk assessment software tools enable users to conduct scenario analysis and stress testing to assess the resilience of their financial plans under different market conditions. These tools simulate various scenarios, such as changes in interest rates, economic downturns, or adverse events, to evaluate the potential impact on key financial metrics and identify vulnerabilities.

Reporting and visualization tools

These tools provide comprehensive reporting and visualization capabilities that enable users to easily communicate and understand the results of their risk assessments. They generate customizable reports and dashboards that present key risk indicators, risk profiles, and mitigation strategies in a clear and concise manner.

Integration with other systems

Financial risk assessment software tools can be integrated with other enterprise systems, such as accounting systems, data warehouses, and risk management platforms. This integration allows for seamless data exchange, automated risk analysis, and centralized risk management.

Challenges of using financial risk assessment software tools

Financial risk assessment software tools can be a valuable asset for businesses, but they also come with some challenges.

One challenge is data quality and availability. The accuracy and completeness of the data used to train and validate the model are critical to the tool’s effectiveness. If the data is inaccurate or incomplete, the model may not be able to accurately assess risk.

Another challenge is model complexity and validation. Financial risk assessment models can be complex, and it can be difficult to validate them. This is because there is often no “ground truth” against which to compare the model’s output. As a result, it is important to carefully consider the model’s assumptions and limitations before using it to make decisions.

Finally, user adoption and training can be a challenge. Financial risk assessment software tools can be complex, and it can take time for users to learn how to use them effectively. It is important to provide adequate training and support to users to ensure that they are able to use the tool effectively.

Data quality and availability

The quality and availability of data are critical to the effectiveness of financial risk assessment software tools. The data used to train and validate the model must be accurate, complete, and relevant. If the data is inaccurate or incomplete, the model may not be able to accurately assess risk.

There are a number of factors that can affect the quality and availability of data, including:

– The source of the data. Data from different sources may have different levels of accuracy and completeness.

– The format of the data. Data may be available in a variety of formats, and it can be difficult to convert data from one format to another.

– The timeliness of the data. Data may become outdated quickly, and it is important to ensure that the data used to train and validate the model is up-to-date.

Model complexity and validation

Financial risk assessment models can be complex, and it can be difficult to validate them. This is because there is often no “ground truth” against which to compare the model’s output. As a result, it is important to carefully consider the model’s assumptions and limitations before using it to make decisions.

Some of the challenges associated with model complexity and validation include:

– The number of parameters in the model. The more parameters in the model, the more difficult it is to validate the model.

– The nonlinearity of the model. Nonlinear models are more difficult to validate than linear models.

– The lack of a “ground truth”. In many cases, there is no “ground truth” against which to compare the model’s output.

User adoption and training

Financial risk assessment software tools can be complex, and it can take time for users to learn how to use them effectively. It is important to provide adequate training and support to users to ensure that they are able to use the tool effectively.

Some of the challenges associated with user adoption and training include:

– The complexity of the tool. The more complex the tool, the more difficult it is for users to learn how to use it effectively.

– The lack of training and support. Users may not have access to adequate training and support, which can make it difficult for them to learn how to use the tool effectively.

– The resistance to change. Users may be resistant to change, which can make it difficult to implement a new tool.

Best practices for using financial risk assessment software tools

Financial risk assessment software tools can be valuable for managing financial risks. By following best practices, organizations can maximize the benefits of using these tools.

To ensure effective use of financial risk assessment software tools, organizations should adhere to several key best practices. These include defining clear objectives, using a structured approach, validating and calibrating models, and communicating results effectively.

Define clear objectives

Before using a financial risk assessment software tool, organizations should clearly define their objectives. This will help them select the right tool and ensure that it is used effectively. Objectives may include identifying and assessing financial risks, quantifying the potential impact of risks, and developing mitigation strategies.

Use a structured approach

Organizations should use a structured approach when using financial risk assessment software tools. This will help them ensure that the process is consistent and repeatable. A structured approach may include steps such as data collection, risk identification, risk assessment, and risk mitigation.

Validate and calibrate models

Financial risk assessment software tools often use models to assess risks. These models should be validated and calibrated to ensure that they are accurate and reliable. Validation involves comparing the model’s results to historical data. Calibration involves adjusting the model’s parameters to improve its accuracy.

Communicate results effectively, Financial risk assessment software tools

The results of financial risk assessments should be communicated effectively to decision-makers. This may involve using clear and concise language, visuals, and presentations. Effective communication will help decision-makers understand the risks and make informed decisions.

Query Resolution: Financial Risk Assessment Software Tools

What are the key benefits of using Financial Risk Assessment Software Tools?

Financial Risk Assessment Software Tools offer a multitude of benefits, including improved risk identification and assessment, enhanced decision-making, increased transparency and accountability, and reduced risk management costs.

What are the essential features of Financial Risk Assessment Software Tools?

Key features of these tools include risk identification and assessment capabilities, scenario analysis and stress testing, reporting and visualization tools, and integration with other systems.

What are the challenges associated with using Financial Risk Assessment Software Tools?

Challenges may include data quality and availability, model complexity and validation, and user adoption and training.

What are the best practices for using Financial Risk Assessment Software Tools?

Best practices include defining clear objectives, using a structured approach, validating and calibrating models, and communicating results effectively.