Financial Risk Assessment Techniques

Delve into the world of Financial risk assessment techniques, an indispensable tool for navigating the treacherous waters of financial risks. From understanding the concept to exploring cutting-edge advancements, this guide will empower you with the knowledge and strategies to safeguard your financial future.

Unveiling the diverse spectrum of financial risks faced by businesses and individuals, we embark on a journey to unravel the strengths and limitations of quantitative techniques like Value at Risk (VaR) and qualitative approaches such as scenario analysis.

Financial Risk Assessment Techniques

Financial risk assessment is the process of identifying, analyzing, and evaluating the potential financial risks that a business or individual may face. It is an essential part of financial management as it helps businesses and individuals make informed decisions about how to allocate their resources and manage their finances.

There are many different types of financial risks that businesses and individuals can face, including:

- Credit risk: The risk that a borrower will default on a loan.

- Market risk: The risk that the value of a financial instrument will change due to changes in the market.

- Operational risk: The risk that a business will suffer a loss due to an operational failure, such as a computer system failure or a natural disaster.

- Liquidity risk: The risk that a business will not be able to meet its financial obligations when they come due.

Quantitative Risk Assessment Techniques

Quantitative risk assessment techniques are mathematical models used to assess the potential financial losses associated with a given risk. These techniques can be used to evaluate the risk of a single investment, a portfolio of investments, or an entire company.

There are a number of different quantitative risk assessment techniques available, each with its own strengths and limitations. Some of the most common techniques include:

- Value at Risk (VaR)

- Expected Shortfall (ES)

- Stress Testing

Value at Risk (VaR) is a measure of the potential loss that an investment could experience over a given time period, with a given probability. VaR is calculated by simulating the performance of the investment under a variety of different market conditions. The VaR is then defined as the maximum loss that the investment is expected to experience with a given probability, such as 95% or 99%.

Expected Shortfall (ES) is a measure of the average loss that an investment could experience over a given time period, given that the loss exceeds the VaR. ES is calculated by taking the expected value of the losses that exceed the VaR. ES is a more conservative measure of risk than VaR, as it takes into account the possibility of extreme losses.

Stress Testing is a technique that is used to assess the resilience of an investment or a company to a variety of different adverse market conditions. Stress testing is conducted by simulating the performance of the investment or company under a variety of different scenarios, such as a recession, a stock market crash, or a natural disaster. The results of the stress test can be used to identify the potential risks that the investment or company faces and to develop strategies to mitigate those risks.

Quantitative risk assessment techniques can be a valuable tool for investors and financial managers. These techniques can help to identify the potential risks associated with an investment or a company and to develop strategies to mitigate those risks.

3. Qualitative Risk Assessment Techniques: Financial Risk Assessment Techniques

Qualitative risk assessment techniques provide valuable insights into financial risks by considering subjective factors and expert opinions. These techniques allow organizations to identify, assess, and prioritize risks based on their potential impact and likelihood, even when quantitative data is limited.

Scenario Analysis

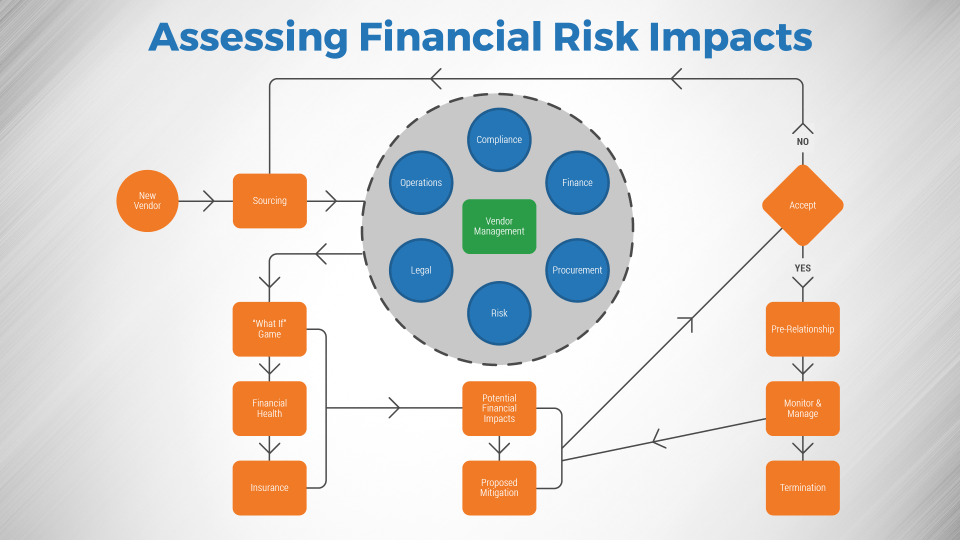

Scenario analysis involves developing hypothetical scenarios that represent potential future events or conditions that could impact the organization’s financial health. Experts or stakeholders collaborate to create these scenarios, considering various factors such as economic conditions, regulatory changes, and operational disruptions. The analysis evaluates the potential consequences of each scenario and helps organizations develop mitigation strategies.

Expert Judgment, Financial risk assessment techniques

Expert judgment leverages the knowledge and experience of industry professionals or subject matter experts to assess financial risks. These experts provide their qualitative assessments of the likelihood and impact of specific risks, often using scoring systems or risk matrices. Expert judgment is particularly valuable when quantitative data is unavailable or limited.

Risk Mapping

Risk mapping involves visually representing the organization’s risks on a two-dimensional matrix. The matrix typically plots the likelihood and impact of each risk, allowing organizations to prioritize risks based on their severity. Risk mapping provides a clear and concise overview of the organization’s risk profile and facilitates decision-making.

Integrated Risk Assessment Approaches

Integrated risk assessment approaches combine both quantitative and qualitative techniques to provide a more comprehensive and accurate assessment of financial risks. These approaches leverage the strengths of both methods, allowing for a deeper understanding of risk factors and their potential impact.

By combining quantitative and qualitative data, integrated approaches enhance the reliability of risk assessments. Quantitative techniques provide objective, data-driven insights, while qualitative techniques capture subjective factors and expert judgment. This combination leads to a more holistic and balanced assessment that considers both hard and soft data.

Benefits of Integrated Risk Assessment Approaches

- Improved accuracy: Combining quantitative and qualitative techniques reduces the risk of relying solely on one type of data, leading to more accurate and reliable assessments.

- Enhanced comprehensiveness: Integrated approaches provide a more comprehensive view of risks by considering both objective and subjective factors.

- Increased flexibility: These approaches can be tailored to specific industries, organizations, and risk profiles, ensuring relevance and applicability.

Examples of Integrated Risk Assessment Frameworks

- Enterprise Risk Management (ERM): ERM frameworks integrate risk assessment across the entire organization, considering both financial and non-financial risks.

- Operational Risk Management (ORM): ORM frameworks focus on assessing and managing risks related to operational processes, including financial risks.

- Credit Risk Management: Credit risk management frameworks combine quantitative and qualitative techniques to assess the risk of borrowers defaulting on their obligations.

Applications of Integrated Risk Assessment Approaches

Integrated risk assessment approaches have wide-ranging applications, including:

- Regulatory compliance: Meeting regulatory requirements for risk assessment and management.

- Risk mitigation: Identifying and prioritizing risks to develop effective mitigation strategies.

- Capital allocation: Determining the appropriate allocation of capital to cover potential losses.

- Strategic planning: Informing strategic decisions by understanding the potential risks and opportunities.

By embracing integrated risk assessment approaches, organizations can gain a more comprehensive and accurate understanding of their financial risks, enabling them to make informed decisions and enhance their resilience.

Emerging Trends in Financial Risk Assessment

The financial risk assessment landscape is constantly evolving, driven by advancements in technology, big data, and machine learning. These emerging trends are transforming the way financial institutions identify, measure, and manage risk.

One of the most significant trends is the increasing use of technology to automate and streamline the risk assessment process. This includes the use of artificial intelligence (AI) and machine learning algorithms to analyze large datasets and identify potential risks that may have been missed by traditional methods.

Impact of Technology, Big Data, and Machine Learning

The impact of technology, big data, and machine learning on risk assessment practices is profound. These advancements have enabled financial institutions to:

- Identify risks more quickly and accurately.

- Quantify and measure risks with greater precision.

- Develop more sophisticated and tailored risk management strategies.

For example, machine learning algorithms can be used to analyze historical data and identify patterns that may indicate future risks. This information can then be used to develop predictive models that can help financial institutions make more informed decisions about risk management.

Potential Challenges and Opportunities

While emerging trends in financial risk assessment offer significant potential benefits, they also present some challenges. One of the biggest challenges is the need for financial institutions to invest in the necessary technology and expertise to implement these new techniques.

Another challenge is the potential for bias in AI and machine learning algorithms. It is important to ensure that these algorithms are trained on unbiased data and that they are not used to perpetuate existing biases in the financial system.

Despite these challenges, the potential benefits of emerging trends in financial risk assessment are significant. These trends have the potential to make the financial system more stable and resilient, and they can help financial institutions to better protect their customers and investors.

Essential Questionnaire

What are the key types of financial risks?

Financial risks encompass a wide range, including credit risk, market risk, liquidity risk, and operational risk.

How can I effectively assess financial risks using quantitative techniques?

Quantitative techniques like VaR and Stress Testing provide numerical estimates of potential losses, enabling you to quantify and manage risks more precisely.

What are the advantages of using qualitative risk assessment techniques?

Qualitative techniques offer valuable insights into risks that may be difficult to quantify, allowing you to identify and address emerging threats.