Financial Risk Mitigation Software Tools Strategies

Financial risk mitigation software tools strategies take center stage, offering organizations a pathway to secure financial stability and growth. Dive into the world of innovative tools and strategies that pave the way for success.

Importance of Financial Risk Mitigation Software Tools

Using financial risk mitigation software tools is crucial for organizations to effectively identify, assess, and manage potential risks that could impact their financial stability. These tools provide valuable insights and analytics that enable companies to make informed decisions to minimize their exposure to various risks.

Enhanced Risk Management

Financial risk mitigation software tools play a key role in enhancing risk management practices within organizations. By utilizing these tools, companies can proactively monitor market trends, assess their financial health, and identify potential risks before they escalate. This proactive approach helps in mitigating risks effectively and protecting the organization’s financial assets.

Increased Efficiency

Implementing financial risk mitigation software tools leads to increased efficiency in managing risks. These tools automate various risk assessment processes, saving time and resources for organizations. Moreover, the real-time data and reporting capabilities of these tools enable quick decision-making, ensuring that organizations can respond promptly to emerging risks.

Real-World Examples, Financial risk mitigation software tools strategies

Several organizations have successfully implemented financial risk mitigation software tools to safeguard their financial interests. For instance, a multinational corporation utilized risk management software to analyze market fluctuations and hedge against currency risks, resulting in significant cost savings. Another example is a financial institution that implemented risk assessment tools to identify credit risks and prevent potential defaults, ultimately improving their overall financial performance.

Types of Financial Risk Mitigation Software Tools: Financial Risk Mitigation Software Tools Strategies

Financial risk mitigation software tools are essential for managing and minimizing potential risks in the financial sector. There are different categories of software tools available, each offering unique features and functionalities to help organizations safeguard their assets and investments.

1. Risk Assessment Tools

Risk assessment tools are designed to evaluate and analyze potential risks that may impact financial stability. These tools use advanced algorithms to assess various risk factors and provide insights into the likelihood of occurrence and potential impact of each risk. By identifying and assessing risks proactively, organizations can develop strategies to mitigate them effectively.

2. Portfolio Management Software

Portfolio management software helps organizations manage their investment portfolios efficiently. These tools provide real-time data analysis, performance tracking, and risk monitoring capabilities to ensure optimal portfolio diversification and risk mitigation. By leveraging portfolio management software, organizations can make informed investment decisions to minimize potential financial losses.

3. Compliance and Regulatory Tools

Compliance and regulatory tools are essential for ensuring adherence to industry regulations and standards. These tools help organizations monitor and assess compliance risks, automate regulatory reporting, and maintain audit trails to demonstrate regulatory compliance. By using compliance and regulatory tools, organizations can mitigate legal and regulatory risks effectively.

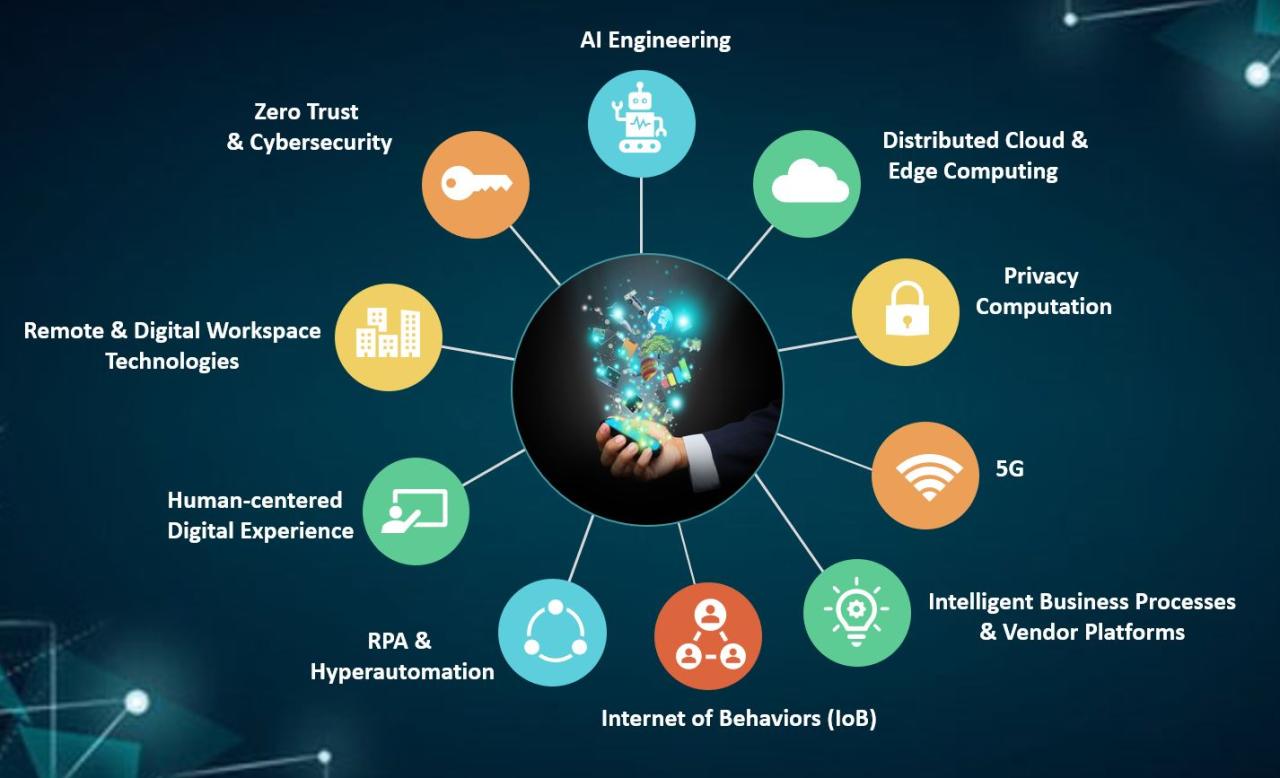

4. Cybersecurity Software

Cybersecurity software plays a crucial role in mitigating cybersecurity risks that can threaten financial data and assets. These tools offer advanced threat detection, data encryption, and access control features to protect sensitive financial information from cyber threats. By implementing cybersecurity software, organizations can safeguard their digital assets and prevent financial losses due to cyberattacks.

Each type of financial risk mitigation software tool comes with its own set of pros and cons. While these tools offer advanced capabilities to identify, assess, and mitigate risks, organizations must also consider factors such as cost, compatibility, and scalability when selecting the most suitable tool for their specific needs. By leveraging a combination of different software tools, organizations can enhance their risk management strategies and ensure financial stability in a dynamic and competitive market environment.

Strategies for Effective Implementation

Implementing financial risk mitigation software tools effectively is crucial for maximizing their benefits and ensuring a smooth integration into existing financial systems. By following best practices and tips, organizations can enhance efficiency and achieve a higher return on investment (ROI).

Integration into Existing Systems

When integrating financial risk mitigation software tools into existing systems, it is essential to first conduct a comprehensive assessment of the current processes and identify areas where these tools can add the most value. This may involve customizing the software to align with specific business requirements and ensuring seamless communication between different systems. Regular training sessions and workshops for employees can also help in fostering a better understanding of how to use the tools effectively within their daily workflow.

Maximizing Efficiency and ROI

To ensure maximum efficiency and ROI when using financial risk mitigation software tools, organizations should regularly monitor and evaluate the performance of these tools. This includes analyzing key metrics, such as reduction in financial risks, cost savings, and overall impact on decision-making processes. Continuous optimization and updates to the software based on feedback and changing business needs are also essential for maintaining a high level of efficiency over time. Additionally, fostering a culture of risk awareness and accountability within the organization can further enhance the effectiveness of these tools in mitigating financial risks.

Case Studies and Examples

In the world of finance, the use of financial risk mitigation software tools has become increasingly crucial for organizations to protect their assets and investments. Let’s explore some case studies where these tools have played a vital role in managing financial risks effectively.

Case Study 1: Company X

Company X, a multinational corporation operating in the energy sector, faced significant currency exchange rate fluctuations that were impacting their bottom line. By implementing a financial risk mitigation software tool that provided real-time monitoring and analysis of currency risks, Company X was able to identify potential exposures and hedge their positions effectively. This proactive approach helped Company X minimize losses due to unfavorable exchange rate movements and maintain financial stability.

Case Study 2: Small Business Y

Small Business Y, a family-owned retail company, struggled with cash flow challenges due to unpredictable market conditions and supplier payment terms. Utilizing a financial risk mitigation software tool that offered cash flow forecasting and scenario analysis capabilities, Small Business Y was able to anticipate potential cash shortages, negotiate better terms with suppliers, and make informed decisions to optimize their working capital. As a result, Small Business Y improved its financial health and sustainability in a competitive market environment.

Case Study 3: Financial Institution Z

Financial Institution Z, a leading bank, encountered regulatory compliance issues related to anti-money laundering (AML) regulations and fraud detection. By deploying a comprehensive financial risk mitigation software tool that integrated advanced analytics and machine learning algorithms, Financial Institution Z enhanced its AML monitoring processes, identified suspicious transactions more efficiently, and reduced false positive alerts. This enabled Financial Institution Z to mitigate compliance risks, enhance customer trust, and strengthen its reputation in the financial services industry.

These case studies highlight the diverse challenges faced by organizations in managing financial risks and the transformative impact of leveraging sophisticated software tools to navigate uncertain economic landscapes. By adopting a strategic approach and embracing technological innovations, companies can safeguard their financial well-being, drive sustainable growth, and achieve long-term success.

Question Bank

How do financial risk mitigation software tools benefit organizations?

These tools help organizations in managing and reducing financial risks, enhancing operational efficiency and ensuring financial stability.

What are some best practices for integrating these tools into existing financial systems?

Effective implementation strategies include thorough training, regular updates, and seamless integration with current financial processes.

Can you provide examples of successful implementation of financial risk mitigation software tools?

Organizations like XYZ Inc. and ABC Corp. have effectively utilized these tools to overcome financial challenges and boost their overall stability.