Successful Merger And Acquisition Strategies

Successful merger and acquisition strategies are crucial for the growth and success of companies in today’s dynamic business environment. This overview delves into the essential components and tactics that drive effective mergers and acquisitions, providing valuable guidance for organizations aiming to navigate this complex process seamlessly.

As we explore the intricacies of pre-merger preparation, negotiation and valuation, and post-merger integration, we uncover the strategies and considerations that can make or break the success of such endeavors.

Overview of Successful Merger and Acquisition Strategies

Successful merger and acquisition strategies are crucial for companies looking to grow, expand their market share, or streamline operations. These strategies involve the consolidation of two companies to create a more competitive and efficient entity.

Key Components of a Successful Merger and Acquisition Strategy

- Clear Objectives: Establishing clear goals and objectives for the merger or acquisition helps align all stakeholders and ensures everyone is working towards a common vision.

- Thorough Due Diligence: Conducting comprehensive due diligence to assess the financial, legal, and operational aspects of the target company is essential to identify any potential risks or obstacles.

- Cultural Alignment: Ensuring that the cultures of both companies are compatible and can be integrated smoothly is key to the success of the merger or acquisition.

- Effective Communication: Open and transparent communication with employees, customers, and other stakeholders is crucial to maintain trust and mitigate resistance to change.

Importance of Strategic Planning in Mergers and Acquisitions

Strategic planning plays a vital role in mergers and acquisitions as it helps companies navigate the complexities of the process and maximize the benefits of the transaction. By developing a well-thought-out plan, companies can identify synergies, mitigate risks, and ensure a smooth integration of operations.

Common Pitfalls to Avoid in Merger and Acquisition Strategies

- Lack of Due Diligence: Failing to conduct thorough due diligence can lead to unforeseen issues and challenges post-merger or acquisition.

- Ignoring Cultural Differences: Neglecting to address cultural differences between the merging companies can result in conflicts and hinder integration efforts.

- Overlooking Communication: Poor communication during the merger or acquisition process can lead to confusion, resistance, and loss of key talent.

- Underestimating Integration Challenges: Underestimating the complexity of integrating systems, processes, and teams can result in operational disruptions and financial losses.

Pre-Merger Preparation

Before embarking on a merger or acquisition, it is crucial to engage in thorough pre-merger preparation to ensure a successful transition. This phase involves conducting due diligence, assessing cultural fit, identifying synergies, and addressing legal and regulatory considerations.

Conducting Thorough Due Diligence, Successful merger and acquisition strategies

Due diligence is a critical step in the pre-merger process, as it involves a comprehensive review of the financial, operational, and legal aspects of the target company. This includes examining financial statements, contracts, intellectual property rights, and potential liabilities. By conducting thorough due diligence, the acquiring company can uncover any red flags or hidden risks that may impact the success of the merger.

Assessing Cultural Fit

Assessing the cultural fit between the merging entities is essential to ensure a smooth integration post-merger. Companies should evaluate factors such as values, communication styles, leadership practices, and organizational structure to determine compatibility. By aligning the cultures of both companies, organizations can minimize conflicts and enhance collaboration during the integration process.

Identifying Potential Synergies

Identifying potential synergies between the merging entities is key to maximizing the value of the merger. This involves analyzing areas of overlap and opportunities for cost savings, revenue growth, and operational efficiencies. By leveraging synergies, companies can create a stronger combined entity that is more competitive in the market.

Legal and Regulatory Considerations

Addressing legal and regulatory considerations pre-merger is crucial to ensuring compliance and mitigating risks. Companies must navigate antitrust laws, intellectual property rights, employee contracts, and other legal aspects that may impact the merger. By proactively addressing these considerations, organizations can avoid legal disputes and maintain a smooth transition process.

Negotiation and Valuation

Effective negotiation and accurate valuation are crucial aspects of successful mergers and acquisitions. These processes require strategic thinking, financial expertise, and a deep understanding of the target company’s worth. Let’s delve into the key points regarding negotiation and valuation in M&A deals.

Effective Negotiation Tactics

Negotiation in mergers and acquisitions involves finding a mutually beneficial agreement between the acquiring company and the target company. Some effective tactics include:

- Understanding the other party’s priorities and concerns

- Being prepared to walk away if the terms are not favorable

- Building trust and rapport with the other party

- Seeking win-win solutions that create value for both sides

Valuation Methods

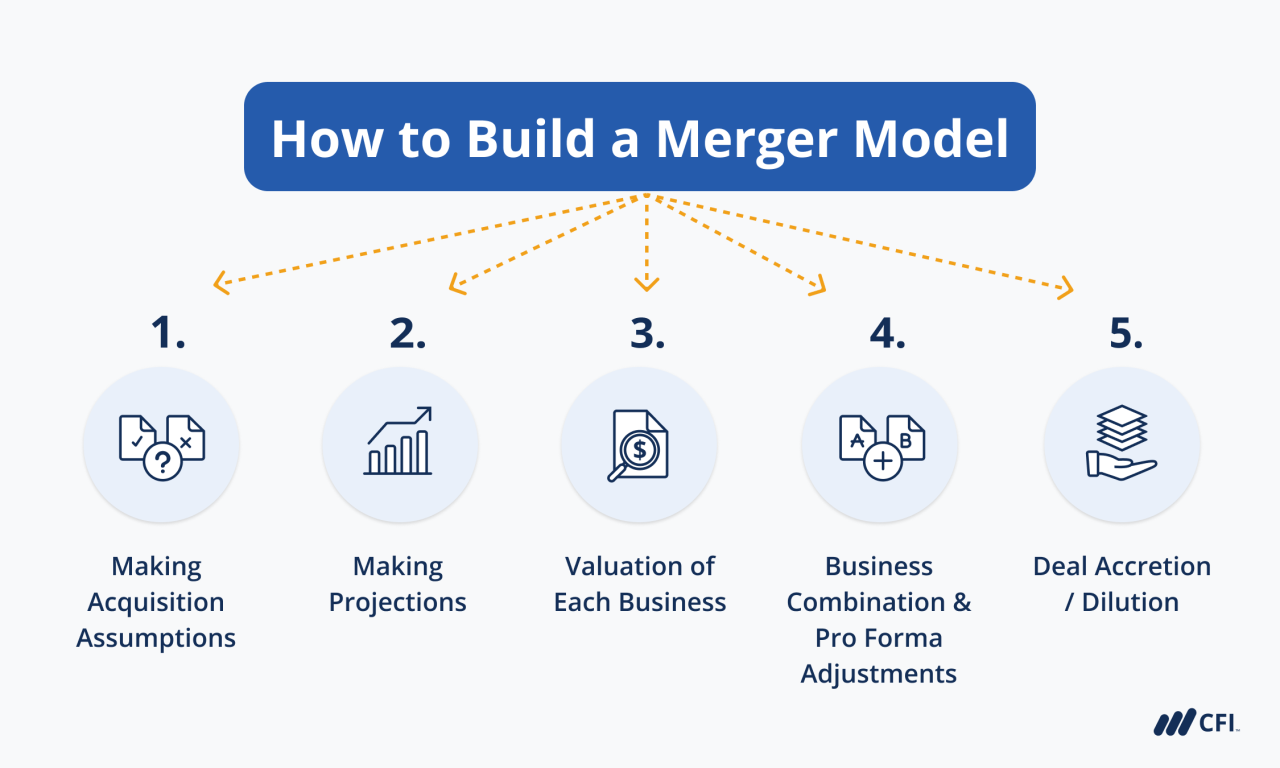

Valuing a target company accurately is essential to determine a fair price and ensure a successful deal. Common valuation methods used in M&A include:

- Comparable Company Analysis (CCA)

- Discounted Cash Flow (DCF) Analysis

- Asset-Based Valuation

- Multiples Valuation

It is crucial to consider multiple valuation methods to get a comprehensive view of the target company’s worth.

Role of Financial Advisors

Financial advisors and experts play a critical role in the negotiation and valuation process of mergers and acquisitions. They provide:

- Expertise in financial analysis and valuation techniques

- Insight into market trends and industry benchmarks

- Guidance on deal structuring and negotiation strategies

- Due diligence support to uncover potential risks and opportunities

Examples of Successful Strategies

One notable example of successful negotiation and valuation strategies is the acquisition of WhatsApp by Facebook. Facebook offered a combination of cash and stock, valuing WhatsApp at $19 billion. This deal showcased the importance of aligning valuation with the target company’s growth potential and market value.

Post-Merger Integration

Successful post-merger integration is crucial for the long-term success of a merged company. It involves combining processes, systems, and cultures to create a unified and efficient organization. Communication and strong leadership play a vital role during this phase to ensure a smooth transition and alignment of goals.

Strategies for Seamless Integration

- Establish a clear integration plan with defined timelines and milestones.

- Identify key stakeholders and involve them in the integration process.

- Focus on cultural integration by promoting collaboration and shared values.

- Implement cross-functional teams to address integration challenges and opportunities.

- Regularly communicate progress updates to all employees to maintain transparency and alignment.

Significance of Communication and Leadership

Effective communication is essential to address uncertainties and concerns among employees during the integration phase. Strong leadership can inspire trust, provide direction, and drive the combined company towards common objectives. Open communication channels and visible leadership create a sense of stability and direction, fostering a positive work environment.

Addressing Employee Concerns

- Hold town hall meetings and Q&A sessions to address employee questions and provide updates.

- Offer support and resources for employees experiencing changes or challenges post-merger.

- Provide training programs to help employees adapt to new processes and technologies.

- Create opportunities for feedback and suggestions to involve employees in the integration process.

Examples of Successful Post-Merger Integration

One notable example is the merger between Disney and Pixar, where both companies successfully integrated their creative talents and resources to produce blockbuster films and expand their market reach.

Another example is the merger between Exxon and Mobil, which resulted in the creation of ExxonMobil, a global leader in the oil and gas industry known for its operational efficiency and strategic focus.

Query Resolution: Successful Merger And Acquisition Strategies

What are some common pitfalls to avoid in merger and acquisition strategies?

Common pitfalls include inadequate due diligence, cultural mismatch, lack of communication, and poor post-merger integration planning.

How important is strategic planning in mergers and acquisitions?

Strategic planning is crucial as it helps in identifying goals, risks, and opportunities, and ensures a structured approach to the entire process.

What role do financial advisors play in the negotiation and valuation process?

Financial advisors provide expertise in financial analysis, valuation, and deal structuring, guiding companies to make informed decisions.